Tokenomics Anatomy (Part 2): Airdrops, FDV Traps & Locked Tokens as Misaligned Incentives

ℹ️ If you haven’t read Part 1 of this series, start there. We broke down three core tokenomics mistakes that silently kill projects before they even list. This is Part 2.

At AlphaMind, we work with web3 projects every single day. On average, I review 10 to 20 token models every week. Pitch decks, whitepapers, tokenomics spreadsheets, token flows, incentive plans, TGE launch timing, listing structures, and everything else...

You’d think by now we’d all know what makes a good token model. After all, the industry has thousands of data points. So many failed launches. So many patterns. So many cautionary tales.

Despite all this, the same patterns repeat.

Founders still make the same mistakes. Not because they’re stupid. But because they’re isolated in their own assumptions. And because too few people tell them the truth about how these structures actually behave in the wild.

This series is our attempt to fix that — one lesson at a time.

Let’s talk about another 3 ways we see promising tokens blow themselves up before they even touch the market.

Mistake 1: Airdrop Addiction

Why Airdrops Backfire

"Everyone loves free tokens. Until they start selling them."

Airdrops sound great in theory. A way to reward early users. Drive engagement. Build hype. Signal generosity.

But in practice, most airdrops become a public execution of token price.

Why? Because:

- Most airdrops are fully unlocked at TGE

- Most recipients never bought the token and never will

- There are no behavioral filters — anyone with a wallet gets free money

- Once listed, the natural instinct is to dump and move on

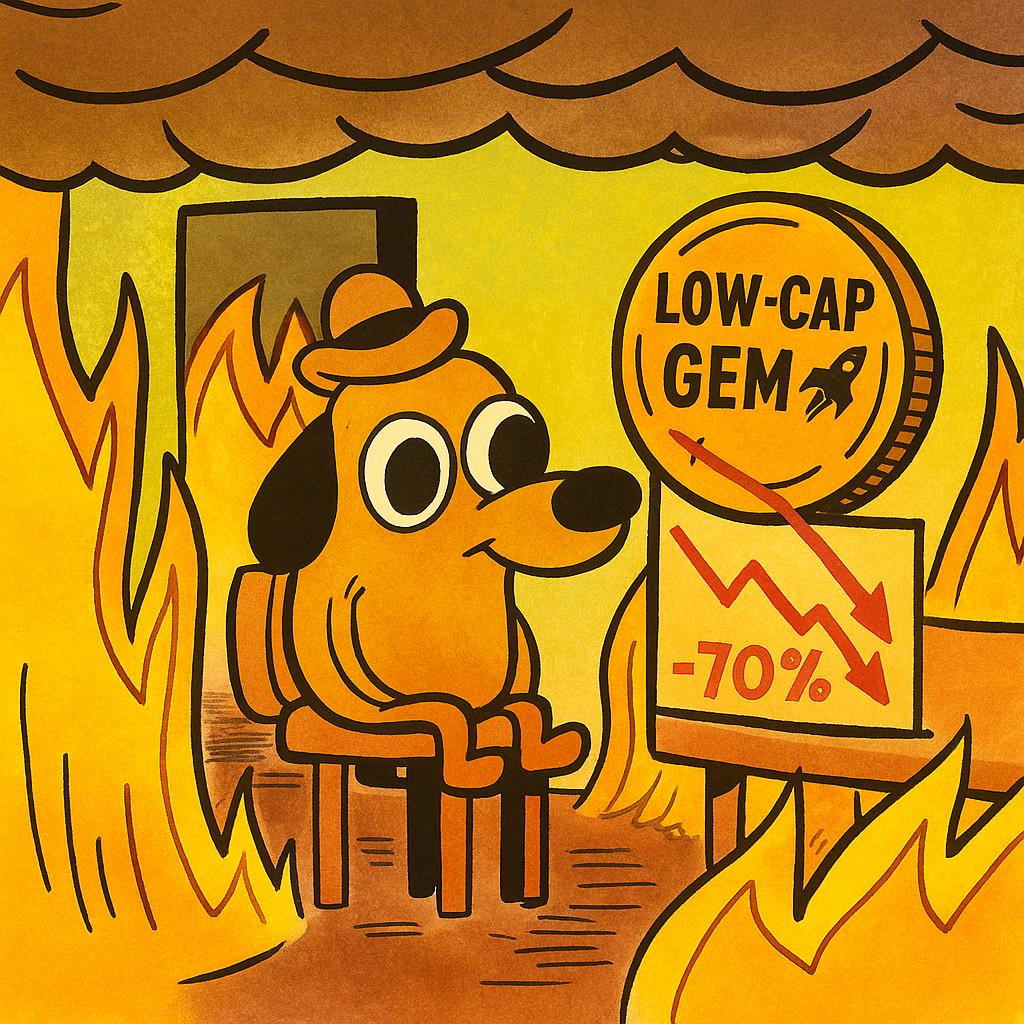

And that’s exactly what happens. Projects celebrate their "successful distribution," only to watch their token collapse 30%, 50%, 70% in days.

Airdrop hunters aren’t holders. They’re extraction bots. And when the free money hits, it gets sold.

The real irony? Most of the retail community still celebrates these mechanics. They beg for airdrops, dream of retroactive rewards—and then wonder why every launch they buy into dumps like clockwork.

If you’ve ever asked "why tokens dump after airdrops?", this is exactly why: the recipients never bought in, and they have no reason to stay.

How to Airdrop without killing token price

Best Practices:

- Never airdrop fully unlocked tokens to unqualified wallets

- If you must airdrop, use vesting, or delay claimability until market is mature

- Consider gated airdrops based on participation or staking behavior

- Align any airdrop with long-term engagement, not short-term metrics

Investor takeaway:

Free money isn’t free. If you see a massive airdrop with instant liquidity, prepare for impact.

Mistake 2: FDV Illusion

The Circulating Supply Trap

“We’re launching at a $500K market cap!” (but actually… $400M FDV)

Projects love to present themselves as low-cap gems. They headline with a tiny initial market cap: $250K, $500K, maybe $1M.

But read the fine print:

- The total supply is in the billions

- Only 5% is circulating

- Insiders' tokens fully unlock in 2 months

What you’re buying isn’t a $500K cap opportunity. You’re buying a fraction of a $300M valuation that’s about to inflate like a balloon.

Why retail gets misled

Retail doesn’t see it coming because most people focus on IMC (Initial Market Cap), not FDV. Worse, they rarely calculate float-adjusted valuations or understand unlock velocity.

For a deeper breakdown of how FDV gets misused as a narrative tool, check out this recent piece from HackerNoon: "FDV Misconceptions in Crypto: Fully Diluted or Fully Deceived?"

Knowing how to calculate float-adjusted FDV can help investors avoid overpaying in misleading launches.

And projects don’t correct the misunderstanding. Because misleading perception drives retail inflows - and that’s what many projects want.

Retail investors should always scan for tokenomics red flags to avoid falling into exit liquidity traps.

How to calculate float-adjusted FDV (in simple terms):

- Start with circulating supply: how many tokens will actually be tradable at TGE or a specific unlock moment.

- Multiply it by the the expected market price (either the sale price or projected listing price).

- That gives you the real FDV for that point in time: not theoretical, but practical.

So, if a token lists with only 3% of supply in circulation, and trades at $0.50 — the float-adjusted FDV is:

3% × total supply × $0.50

That’s the valuation the market is actually absorbing, and it matters more than the final “theoretical” FDV.

Best Practices:

- Be honest about fully diluted valuation and upcoming float

- Retail investors should evaluate real float-adjusted FDV at each major unlock event

- Founders: don’t hide behind tiny IMC numbers: it backfires when price collapses

Investor takeaway:

If the token structure hides the real valuation, that’s not a discount. That’s a trap.

Mistake 3: Fear-Based Token Design

Defensive Tokenomics Kills Momentum

"If we lock everything long enough, maybe no one will dump... or buy?!"

This is one of the most common self-sabotage patterns we see.

Founders are scared. They’ve seen other tokens crash. They’re nervous about the market. So they decide to play defense:

- 1% TGE unlock

- 12-month cliffs

- Delayed listing

- Zero liquidity

On paper, this protects the price. In reality, it kills momentum.

You can’t attract demand for a token that doesn’t exist. No one wants to buy into a market that isn’t live.

Without a realistic token launch strategy that matches unlocks to demand, most teams stall out before they ever gain traction

Building with Courage, Not Caution

We’ve seen tokens with perfect unlock curves and beautiful pie charts that never make it off the ground and fail. Because everything was frozen. And buyers moved on.

Best Practices:

- Match unlocks with liquidity, narrative, and real interest

- Small unlocks are fine, but don’t delay listing unless absolutely necessary

- Create early use cases and real-time value, not just future promises

Investor takeaway:

If even the team is scared to release the token, why should you be excited to buy it?

Final Thoughts: Designing for Alignment, Not Hype

At AlphaMind, we don’t just review pitch decks: we review how incentives align and behave in the real world. That’s what tokenomics is, at its core: incentive engineering.

The goal isn’t just to survive TGE. It’s to create alignment between builders and buyers.

But here’s the reality we see daily:

- Most projects don’t fail because they lack vision.

- They fail because they misalign the economics.

- They overpromise.

- They underdeliver.

- They build for metrics, not behavior.

And in the process, retail gets wrecked over and over again.

But it doesn’t have to be this way.

If you’re a founder reading this: design with honesty. Don’t hide behind cliffs and charts. If your token can’t stand in the market, it’s not ready.

If you’re a retail investor: ask sharper questions. Look beyond hype. Dig into unlock schedules, valuation, supply, utility. Don’t trust vibes — trust mechanics.

Because in Web3, you’re not just buying a token.

You’re entering a system.

You better know who it serves.

More in the "Tokenomics Anatomy" series by AlphaMind coming soon... If you missed Part 1, read it here:

Stay Smart, Stay Early

We’re building a smarter retail community: one that backs web3 projects with real fundamentals and real upside.

If that sounds like your kind of Launchpad, join us.

Remember: we're always here for you:

Website | Twitter | Discord | Telegram | YouTube

Let’s keep building. See you on-chain.