Tokenomics Anatomy (Part 3): When Even RWA Tokens Become Exit Liquidity

Why some tokens are dead on arrival — even if the product works

This is Part 3 of our ongoing Tokenomics Anatomy series. In Part 1, we dissected five lethal mistakes we’ve seen across Web3 launches. In Part 2, we covered dangerous patterns in airdrops, FDV illusions, and fear-based token design.

But this one’s different.

Here’s a story from our dealflow: a fancy RWA project with a real product, real revenue, a decent team & famous advisors... But we decided to pass because they pitched a token that fundamentally didn’t belong.

We’ll walk you through how it looked on the surface, why we passed, and what both founders and investors can learn from it.

Tokenomics Design Mistake 1: A Token No One Wants (or Needs)

The product worked. That wasn’t the issue.

It was a live Web2 platform: real users, real ticket sales, real-world traction. Impressive, at first glance. But take one step closer — and the token was invisible. Not stealth-launched. Invisible by design.

When we asked why, the team proudly described this as a feature:

“The UX is so smooth, users don’t even know they’re buying NFTs. We never bothered them about the token.”

And that’s indeed clever. Right up until you try to sell that same token.

There was no mention of the token in the product, no reason for users to acquire it, no value tied to using it. And when we asked, “Could you integrate it in the future?” the answer was:

“Legally, no. And honestly, it’s not the right user base.”

So let’s be clear:

That’s not just a UX choice. That’s not just an architectural flaw.

That’s a fundamental mismatch between what the token is, and who it’s for.

But here’s the real problem - our elephant 🐘 in the room:

Despite all this, the team was gearing up to sell the token to retail investors. Not VCs. Not insiders. The same people who would never interact with the product were being told the token had “utility,” “upside,” “demand.”

Think about it.

One audience (the actual product users) is shielded from the token, maybe for legal or UX reasons.

The other audience (crypto retail) is being pitched a utility that doesn’t exist.

That’s not just a red flag. That’s misalignment turned into a pitch deck.

It may not be a scam in the rugpull sense - no malicious intent, no sudden drain - but it’s still a misrepresentation of value. And when founders do this unknowingly, it’s not better. In some ways, it’s worse.

Because it means they’re not just misleading investors, they’re misleading themselves.

What to Fix

- If the product users don’t need the token, don’t build one (or at least don’t sell it to others).

- Don’t claim utility where there is none: not to investors, not to yourself.

- If regulatory limits prevent token integration, revisit the model, not just the messaging.

Best Practices:

- Build token mechanics into the core user flow, not as an optional extra.

- Identify who your first 1,000 token buyers are, and why they’d want it.

- Make sure regulatory limitations don’t eliminate your ability to create demand.

Investor Takeaway:

Ask yourself as an investor:

- Who is the token actually for?

- If product users will never touch it, and founders admit it - then what are you really buying?

Because if a token isn’t designed to be used - it’s not utility. It’s inventory.

Mistake 2: Asymmetric Price Architecture: Retail Buys the Exit Bag

This one wasn’t even hidden.

The public round was priced 3x higher than the seed. 1.5x higher than the private/KOL round. And vesting? Practically identical. Everyone got 10–15% unlocked at TGE, followed by a short cliff and linear vesting schedule.

There were no retail bonuses. No safety buffer. No delay to protect new buyers from early dumps.

So let’s call it what it was:

A system where early investors exit, and retail holds the bag.

There’s nothing inherently evil about price tiers. But when the unlocks are synchronized across wildly different cost bases, what you’re building isn’t a fair launch. It’s an engineered liquidity trap.

You’re not selling opportunity.

You’re selling exit routes.

And this isn’t just “a tough deal” for retail.

It’s retail being inserted as exit liquidity by design.

Worse: the team was positioning the listing as a milestone. A celebration. The big bang moment. But when your first public market event involves unlocking tokens for insiders holding cheaper inventory, that’s not a launch.

That’s payday.

And it’s not yours.

Takeaway:

If early participants can dump 3-4x cheaper tokens into the same float window as retail, you’ve created an adversarial structure.

It’s not just “retail at a disadvantage.” It’s retail inserted as a liquidity outlet by design.

Best Practices:

- Match unlock pace to entry price. The cheaper the token, the slower the exit.

- Use dynamic pricing, retail discounts, or cliffs to create fair entry for late rounds. Delay insider cliffs if retail has zero protection.

- Treat listing as the starting line, not the finish line. Value creation doesn’t end at TGE, it begins there.

Investor Takeaway:

Before buying in, always ask:

- Who’s unlocking when you are?

- At what price did they enter?

- Is your capital creating growth, or just giving someone else their exit?

Because if you’re buying at the top of the funnel while others are exiting below cost…

You’re not investing.

You’re subsidizing.

Mistake 3: The Token Serves No Economic Function. The Utility Theater

This one felt very familiar. The team handed us a tidy list of token “utilities”:

- Discounts on merch

- Access to crowdfunding events

- Staking perks and Governance voting

On paper, it all sounded fine. But when we actually looked under the hood?

None of these:

- Drive primary user behavior

- Are required for platform use

- Were visible in the current product

Merch wasn’t live. Crowdfunding was TBD on the roadmap. Voting had no framework. And staking was just a higher APY button.

The token was not needed to access the product, not tied to revenue, and not promoted to existing users.

This wasn’t underutilized utility.

This was fake utility: a theatrical prop slapped onto a functioning business model.

We call this the Shell Token: a token with no role, no weight, no necessity.

It’s the kind of thing that gets added last-minute, not because it makes sense, but because “we’re doing a Web3 raise, so we need a token.”

You wouldn’t build a car with a decorative engine. So why build a product with a token no one needs to touch?

Takeaway:

A token that isn’t economically, behaviorally, or strategically required will always be sold, never held.

Best Practices:

- Tie the token to core actions that matter: payments, rewards, priority access, platform benefits.

- If the token doesn’t drive user behavior, it won’t drive value and doesn’t deserve to exist.

Run this test:

If we removed the token tomorrow, what breaks?

If the answer is “nothing”, then your token is just standing in the way.

Investor Takeaway:

If users don’t need the token to do anything meaningful, why would anyone hold it?

Ask yourself as an investor:

- What role does the token play in revenue or retention?

- Is holding the token a prerequisite — or just a visual feature?

- Is this token necessary — or just expected?

No revenue capture = no upside.

Because if a token doesn’t drive value, behavior, or strategy - it won’t survive.

It’ll just float. Until it sinks.

Final Thoughts: Tokenomics Starts With the User, Not the Investor

This case shows a common trap in Web3 product-token dynamics:

You can have traction, team, partnerships, and still have a token that’s DOA.

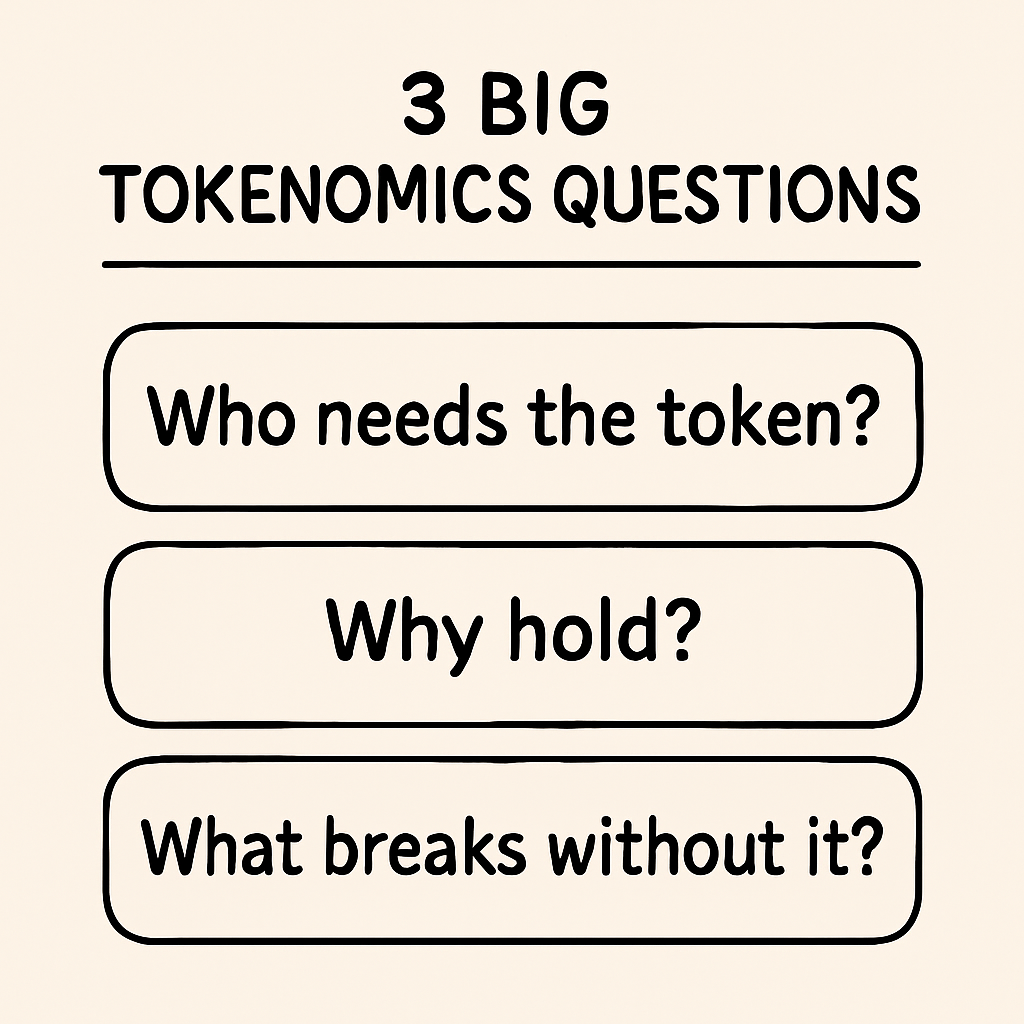

The real questions are brutally simple:

- Who needs the token?

- Why would they hold it?

- What happens if the token disappears?

If the answer is “nothing,” then the token has no future.

At AlphaMind, we don’t just look at pitch decks or buzzwords. We ask how the token works in the wild: with real users, in real flows, under real conditions.

That’s how we protect retail. That’s how we filter signal from noise.

Join AlphaMind

Subscribe to our blog or follow us on socials to catch the next entries in this series.

We're always here for you:

Website | Twitter | Discord | Telegram | YouTube

If you’re building, build with clarity.

If you’re investing, invest with conviction.

AlphaMind helps you do both, without the noise.

Join AlphaMind, where smart retail backs projects that actually make sense.