Tokenomics Anatomy: 3 Mistakes That Kill Projects & Wreck Retail After Listing

At AlphaMind launchpad, we see hundreds of Web3 projects from the inside — before the hype, before the influencers, before the listing. And we’ve learned something that no whitepaper ever tells you:

Tokenomics isn’t a spreadsheet.

It’s not some formula you can tweak until the numbers look right.

It’s not Excel and not even math, really.

It’s game theory. It’s psychology. It’s a battlefield. And it can destroy your investment to 0 before a token ever hits the market, long before TGE and exchange listing.

We’ve watched promising projects fall apart from mistakes that could’ve been avoided: bad timing, broken incentive loops, unrealistic unlocks, naive assumptions. And these aren’t rare outliers. These mistakes happen all. the. time.

So we’re doing something about it.

Welcome to Tokenomics Anatomy - a series we’re launching not to shame projects, but to protect and arm our retail community (and anyone investing early) with what really matters.

Every post in this series is grounded in real-world cases we’ve analyzed through our launchpad: from deals we declined - to tokens we almost launched.

⚠️ FYI: Projects' names are redacted, but the lessons are real.

So if you’ve ever looked at a token sale and thought: “This looks solid… at least on paper” — you’re in the right place.

This isn’t theory. This is crypto survival training.

What Tokenomics Really Means (and Why You’ve Been Looking at It Wrong)

Most retail investors - and even many crypto founders - think tokenomics is just a set of numbers.

You’ve probably seen it yourself: FDV, IMC, unlock schedules, vesting cliffs, supply caps. And of course, some pie charts that everyone loves.

Looks clean. Feels complete. But it’s not.

Real tokenomics is not about the numbers. It’s about the power behind the numbers.

It’s about:

- Who has control over token supply and liquidity?

- When and how value (not just tokens) becomes available?

- Whether there’s any reason to buy or hold besides flipping.

- Whether the token does anything - or is just a placeholder for speculation.

And most importantly:

- Who among stakeholders is structurally protected from the downside?

- And who is structurally exposed to it?

This isn’t just about “who gets paid.” It’s about how the system is built to serve or sacrifice the retail holder.

Ask yourself:

- Will I be the one providing liquidity to insiders?

- Am I buying utility & traction, or just buying hope?

- Will this token actually be usable, or is it a time bomb disguised as a discount?

💡 Tokenomics is not just what’s written. It’s also what’s not written — what’s flexible, off-chain, or hidden in strategy.

Like:

- Incentives pools that are technically locked, but not enforced on-chain.

- Treasury wallets that can dump under the radar.

- Token “Utility” that requires KYC, has GEO restrictions or doesn’t exist yet.

So yes, numbers matter. But what matters more is context, control, and credibility.

That’s why in this series — Tokenomics Anatomy — we’re breaking down not just what projects say, but how their tokens are structured to behave.

Because when the market opens, the spreadsheet won’t protect you.

(You may also read: Key Tokenomics Metrics to Consider)

3 Tokenomics Mistakes That Kill Projects (and How to Spot Them Early)

For the first article in the Tokenomics Anatomy series, we summarized three real-world tokenomics mistakes we’ve seen firsthand — patterns that quietly sabotage promising projects before they even list.

These are some of the red flags our investment analysts catch during project due diligence on AlphaMind, and you won’t find them explained like this in public decks or Medium posts.

If you’re a retail investor, this might help you avoid being someone else’s exit liquidity.

If you’re a crypto founder, maybe it helps you avoid building a pump-and-dump by accident.

Time to break them down:

⚠️ Mistake 1: Separating TGE from Listing in Time

“Let’s issue the tokens now, and list them later. That way we’ll calm retail, and reduce sell pressure.”

What happened:

In a Project (let's call it XYZ without revealing the real name), the team planned to conduct the TGE in January, while delaying DEX listing until March. Their reasoning was twofold:

- They believed retail holders just wanted to “see” their tokens unlocked. They assumed that distributing tokens into wallets — even if those tokens weren’t tradable — would satisfy investor expectations and buy time for listing later.

- They also hoped early holders would use the unlocked tokens in the product. By giving access but removing liquidity, they expected users would stake, lock, or engage with the token — thus absorbing sell pressure before it hits a live market.

Why it seemed logical — but isn’t:

While this sounds clever on paper, in practice it creates more problems than it solves:

- ❌ Illiquid tokens are not real assets. If a token sits in a wallet but can’t be traded, its perceived value drops. It becomes “dead capital.”

- ⚠️ Unlocking tokens before listing opens the door to fake pools and scams. Anyone can spin up a counterfeit DEX pool and frontrun the real listing. Early holders become targets of rugpulls and MEV.

- ❌ The “use-it-in-product” fallback doesn’t hold. Retail users rarely engage with utility until the token has a known market value. And many aren’t eligible to use the product (geo-blocking, KYC, etc.).

- Most importantly: this is perceived as manipulation. Investors are forced into holding or staking something they can’t exit. That erodes trust.

Why this happens:

This mistake doesn’t always come from malice — often, it’s fear. Founders want to:

- Prevent early dumps

- Buy time to finish integrations or product

- Show that tokens are “live” without facing the market yet

But in doing so, they forget a key truth of tokenized markets:

💡 The token only “exists” once it can be traded.

Everything before that — contracts, unlocks, staking — is just administrative.

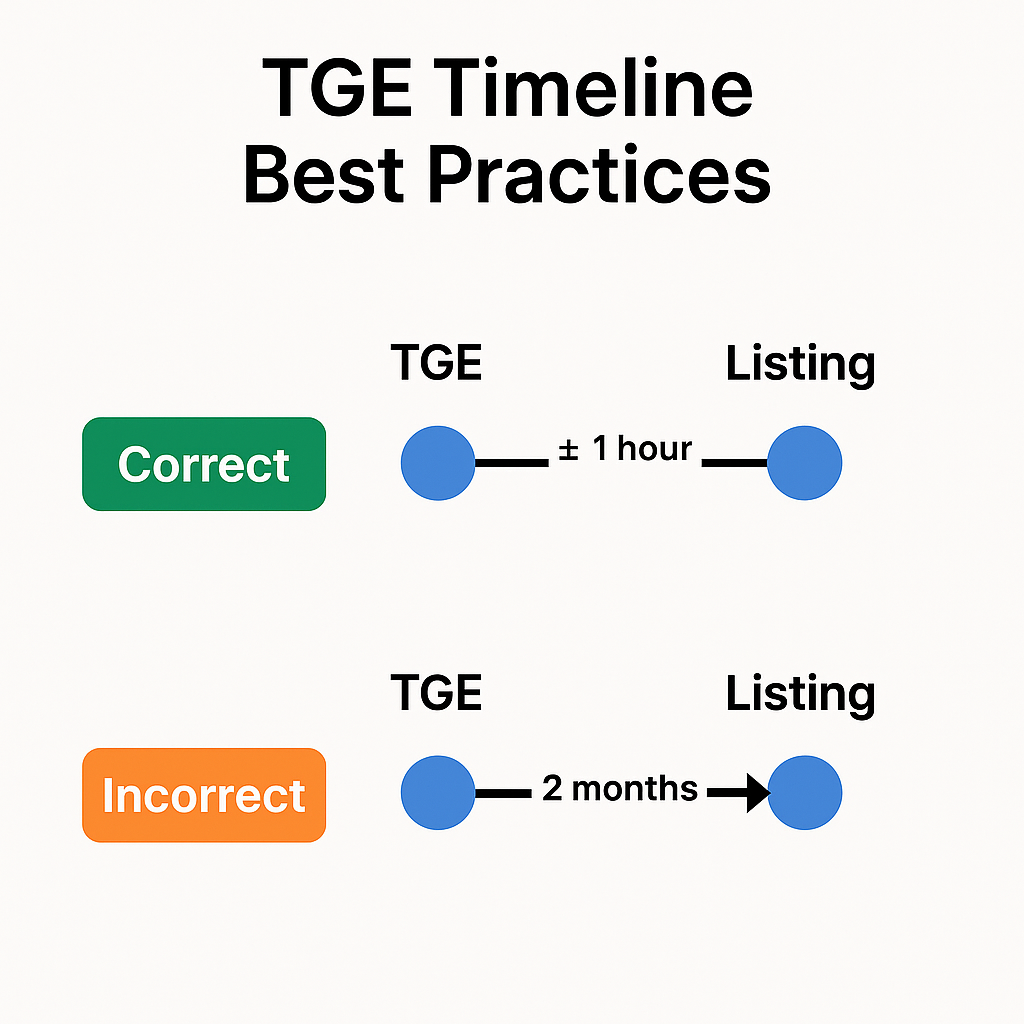

✅ TGE Best Practices:

- TGE should be aligned with market readiness. That doesn’t mean “simultaneous to the first listing,” but it must be functionally synchronized.

- Ideal window:

- TGE + DEX listing within 0–2 hours

- Optional delay in claim (to let the MM stabilize price), but not in liquidity

- If the listing must be delayed due to market conditions, then delay the TGE too. Vesting should not start if there’s no market.

- Never issue unlocked, non-tradable tokens unless they’re gated for pure in-product utility with zero speculation — which is extremely rare.

Investor takeaway:

If a project plans to unlock tokens before you can trade them — ask why.

If there’s no good reason, that’s not strategy — it’s misdirection.

⚠️ Tokenomics Mistake 2: Giving Crypto KOLs Better Terms Than Retail

“Let’s onboard KOLs and give them tokens — they’ll hype the project for us.”

But hype without alignment is a trap.

What happened:

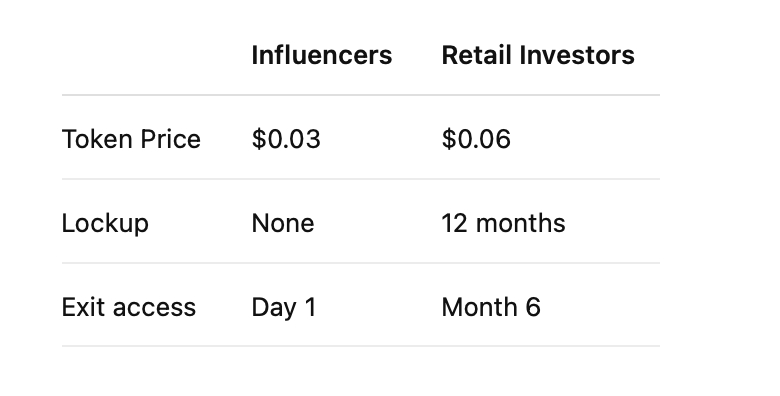

In so many projects, influencers (KOLs) were given early token allocations:

- At better prices than retail

- With little or no lockup

- In exchange for tweets, YouTube videos, or newsletter mentions

Meanwhile, retail investors were offered:

- Higher token prices

- Longer vesting

- Zero ability to exit early

Why it backfires:

- Influencers dump fast. KOLs are incentivized to take profits on listing day. Most are not holders — they are media operators.

- Retail becomes the exit. The very users who followed the KOL’s content are the ones buying their dump.

- Buy pressure is overestimated. Just because a token is “visible” on Twitter doesn’t mean people will buy. Exposure without conviction is noise.

- Token price collapses early. Even with good fundamentals, the listing is overwhelmed by sell pressure from misaligned promoters.

Why this happens:

Founders believe influencer marketing = guaranteed conversion.

But what they miss is:

KOLs without lockups = mercenaries, not partners.

Influencers do bring reach — but if they have liquid tokens and no skin in the game, they become short-term extractors.

KOL Allocations Best Practices:

Any KOL token allocation must have:

- Cliff + vesting (e.g. 2–3 months min)

- Aligned price entry (no 50% discounts vs retail)

- Transparent role and disclosure

- If possible, tie rewards to performance KPIs, not just posts.

- Ensure retail terms are never worse than hype partners. Otherwise, your most loyal buyers become someone else’s liquidity.

Investor takeaway:

If a project offers better terms to influencers than to you —

you’re not being marketed to.

You’re being farmed.

⚠️ Tokenomics Mistake 3: Fake Utility — When a Token Promises Use, But Delivers Nothing

“The token has real use in the product!” …except no one can use it. Or needs to. Or wants to.

Many projects love to claim strong token utility (ed. What is Token Utility?). On paper, it sounds great: “Stake to earn”, “Access premium features”, “Boost rewards”, “Vote in governance.”

But once the token goes live, reality hits:

- The product may not be ready

- Utility may be gated by KYC, devices or geo-blocks

- Most users don’t need the token to use the product

- Sometimes the utility is purely cosmetic or optional

Why it fails:

- If no one needs the token, no one buys the token

- Unlocking without demand turns a token into dead weight

- “Governance” and “staking” are not real utility if they don’t drive real behavior

- Roadmap promises don’t substitute for actual utility at TGE

Why this keeps happening:

Founders confuse “planned utility” with actual value. They assume users will hold out of loyalty — or worse, that price action alone will create demand.

But utility that can’t be used — or doesn’t matter — is the same as no utility at all.

Fake Token Utility: Red Flags to Watch For

- The product works fine without the token

- “Utility” = staking, governance, or minor cosmetic perks

- Access gated by KYC or unavailable in major regions

- Utility “coming soon” — but token unlocks now

- No hard dependencies: users can participate without holding the token

If you spot more than one of these, you’re not buying a token — you’re buying delay.

Investor takeaway:

Before you buy in, ask: What can I actually do with this token on Day 1?

If the answer is vague, you already have your answer.

To be continued...

These are just the first three mistakes we’ve seen kill momentum before it ever begins. There are more — and they’re coming next.

Stay sharp. Stay early. Stay skeptical. Subscribe to our blog and follow us on social - Part 2 is coming soon with even more critical tokenomics traps you need to avoid.

We're always here for you:

Website | Twitter | Discord | Telegram | YouTube

Let’s keep building. See you on-chain.