Project Memo from A to Z: How to Read Project Memos and Spot Early Gems

If you’ve ever stared at a blockchain white paper wondering, “Where do I even begin?” - you’re not alone.

For retail investors like you, doing proper due diligence before buying into an early-stage crypto project often feels overwhelming. Whitepapers are technical. Twitter threads are biased. Reddit is a mix of signal and noise.

That’s why we at AlphaMind created project memos - your shortcut to understanding whether a project is worth your time and your money.

Think of these memos as CliffsNotes for crypto investors: curated by analysts, simplified for retail, and packed with just the essentials you need to decide whether to dive deeper.

⚠️ Remember: Even the best memo can’t eliminate risk. Use it as a starting point, not an endpoint.

📖 What Is a Project Memo? A Quick Breakdown

Project Memo is the first thing you see when you head to the IDO page. A plain-English explanation of what the project is building and why it matters. No jargon. Just the real-world problem they’re solving and how their solution could shake up an entire industry.

Next, it breaks down the token’s role in the ecosystem. Will people actually use this token for anything other than speculation? The memo tells you. It explains how demand is created and whether the token has staying power.

Then you notice hard numbers. Traction metrics: users, revenue, partnerships. Is this just an idea on paper or a living, breathing product with people already using it? You see the proof.

A section on the team’s background follows. You’re not just seeing names, you’re learning about past successes, exits, and whether they’ve been KYC-verified.

And finally, your eyes land on the Risks & Opportunities section. You nod. “At least they’re not sugarcoating it.” The memo highlights potential pitfalls right alongside the upside.

But here’s the catch:

Even with all this clarity, a voice in your head whispers:

“Don’t just take their word for it. DYOR - Do Your Own Research.”

Because while project memos are a brilliant shortcut for cutting through the noise, they’re not a crystal ball. They’re tools - not guarantees. And the smartest retail investors know that combining memo insights with their own digging is where the real alpha lies.

This isn’t like a YouTube hype video from an influencer chasing views. This is due diligence made digestible, curated by real analysts who’ve done the heavy lifting for you. But the final decision, and responsibility, still sits with you.

📂 What Does a Project Memo Consist Of?

So, you’ve got a project memo open in front of you. It’s sleek, concise, and designed to give you all the essentials without overwhelming you. But what’s actually inside? Let’s break it down:

📝 1. The Problem & Solution

At the bottom, you’ll find the “why” of the project.

- What pain point is this project solving?

- Why does it matter in the real world?

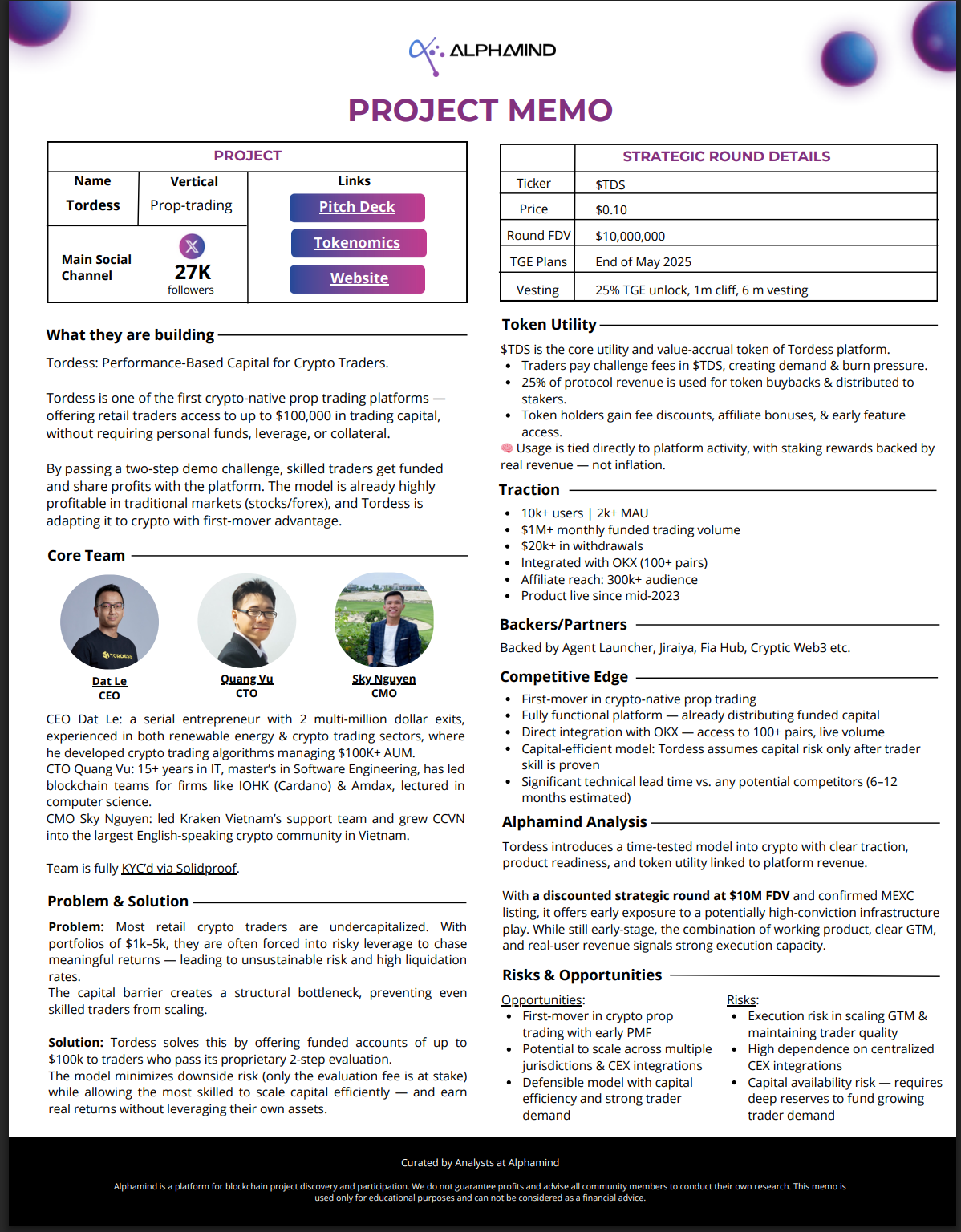

For example, Tordess tackles a huge issue in crypto trading: most retail traders are underfunded and forced into risky leverage. Their solution? Fund skilled traders with up to $100K capital after passing an evaluation challenge.

This section gives you context - and helps you decide if the project is addressing a real need or just hopping on a trend.

💠 2. Token Utility

This part answers a critical question: Why does the token exist?

- Is it just a speculative asset, or is it actually required to use the platform?

- Does it have built-in demand drivers like staking, fees, or discounts?

Strong token utility = stronger long-term value. For instance, EarnPark’s $PARK token lets users unlock higher APYs and fee discounts directly tied to platform activity.

📈 3. Traction & Adoption

Here’s where you separate ideas from execution.

- Are there already users, partnerships, or revenue?

- Or is everything still “coming soon”?

Numbers matter here:

- Tordess boasts 10K+ traders and $1M+ in monthly trading volume.

- Soulbound TV has 60K+ users and paying clients like Avalanche.

The more real-world traction, the lower the risk of this being vaporware.

👥 4. The Team

Scroll down and meet the people behind the project.

- Are they experienced founders with a proven track record?

- Are they KYC-verified to avoid anonymity risks?

For example, Soulbound TV’s CEO Casey Grooms previously built a mobile ad tech platform with $80M annual revenue. That’s the kind of track record you want to see.

🔓 5. Tokenomics & Vesting Schedule

Finally, the numbers:

- What’s the fully diluted valuation (FDV) in the current round?

- How and when do tokens unlock (vesting)?

Good memos call this out upfront, showing whether the token unlock schedule is retail-friendly or stacked for insiders.

🪙 Alphamind Project Memo Examples

Let’s walk through three real memos from Alphamind, so you can see how this works in practice.

🪙 Tordess: Empowering Underfunded Crypto Traders

💡 The Problem: Retail traders are stuck with small portfolios and often risk it all on leverage.

💡 The Solution: Tordess funds skilled traders with up to $100K once they pass a 2-step evaluation challenge.

Why It Matters for Retail Investors:

✅ First-mover advantage in crypto-native prop trading

✅ Fully functional platform, already live

✅ $TDS token utility tied directly to platform revenue

📅 Sale Date: End of May 2025

🎥 Soulbound TV: Livestreaming Meets Web3

💡 The Problem: Twitch and YouTube take huge cuts from creators, leaving them and their audiences powerless.

💡 The Solution: Soulbound TV creates a decentralized livestreaming platform where creators and viewers both earn.

Why It Matters for Retail Investors:

✅ 60K+ users and institutional clients like Avalanche

✅ $SBX token powers tipping, AI agents, and prediction markets

✅ Real revenue before TGE—a rarity in Web3

📅 Sale Date: July 2025

💹 EarnPark: Simplifying Yield for the Masses

💡 The Problem: DeFi yield platforms are too complex or risky for average investors.

💡 The Solution: EarnPark offers structured yield products with transparent risk tiers and SEC compliance in 180+ countries.

Why It Matters for Retail Investors:

✅ $900K revenue in 2024 (pre-TGE!)

✅ $PARK token unlocks higher APYs and discounts

✅ Strategic round at only $10M FDV

📅 Sale Date: September 2025

📝 Your Retail Investor Due Diligence Checklist

✅ Read the memo and highlight red/green flags

✅ Research the team on LinkedIn and Twitter

✅ Check if tokenomics favor long-term holders

✅ Look for real traction, not just promises

✅ Join the project’s community (Telegram, Discord) to gauge sentiment

❓ FAQs: Project Memos and Retail Due Diligence

Q1: Can I rely on project memos alone?

No, use them as a starting point for your own research.

Q2: Are these memos only for big investors?

No, retail investors can use them too, especially on platforms like Alphamind.

Q3: How risky are early-stage projects?

All early-stage investments carry risk. Only invest what you can afford to lose.

🏁 The Takeaway: Memos Make Smarter Retail Investors

As a retail investor, time and information are your most valuable assets. Project memos help you cut through the noise, spot real opportunities, and avoid costly mistakes.

The next time you’re staring at a promising project on Alphamind, remember: a 10-minute memo read today could save you months of regret tomorrow.

🔗Connect with AlphaMind

We're always here for you: