Linea Tokenomics Unpacked & What it Means for Builders, Investors, and the Ecosystem

A no-bullshit breakdown of Linea tokenomics, airdrop mechanics, and dual-burn model. Everything founders, investors, and degens need to know ahead of the 2025 Linea TGE, with honest analysis you won’t find anywhere else.

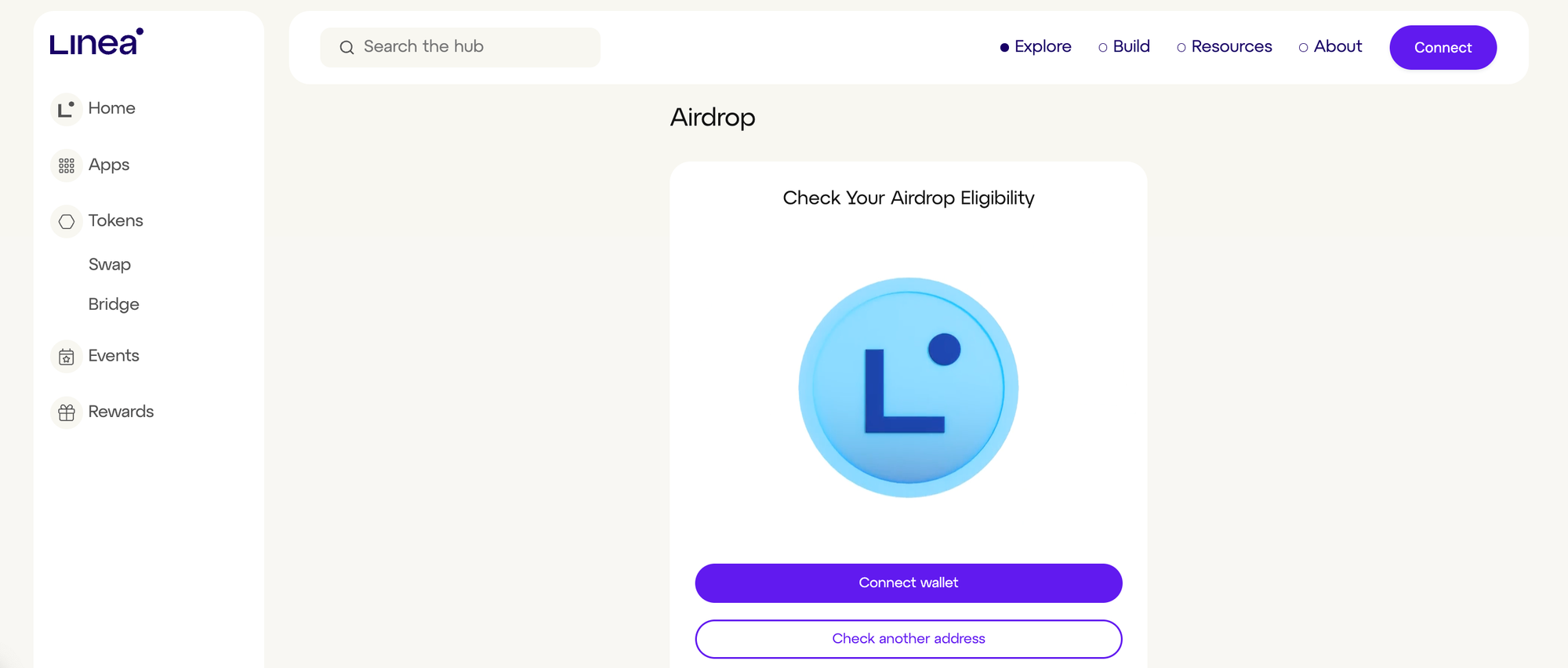

Big news of September: Linea finally announced it's TGE and even published an airdrop eligibility checker.

And we're not here to sugarcoat it.

Linea’s token launch is one of the most anticipated (and controversial) events of 2025. After a year of “Voyage” campaigns, NFT drops, bridge farming, and the sort of relentless quests for LXP and LXP-L points farming, that only crypto can inspire, the TGE and airdrop is finally close - and two-thirds of users got rekt.

Telegram went nuclear. Twitter’s full of salt.

But if you want to try to understand why the community is so divided, what are the fundamentals of Linea tokenomics, and whether Linea’s model is a legit turning point or just a new flavor of pain - read this post till the end.

This is the only guide you’ll need.

Linea token TL;DR: No Fluff, Just Facts

- Linea TGE is live next week: 72B total supply, ~16B (22%) liquid at launch.

- ETH is gas. LINEA token isn’t. Token is strictly for ecosystem, incentives, and (eventually) governance.

- Dual-burn model: 20% of net fees burned as ETH, 80% used to buy/burn LINEA. No L2 has tried this at scale.

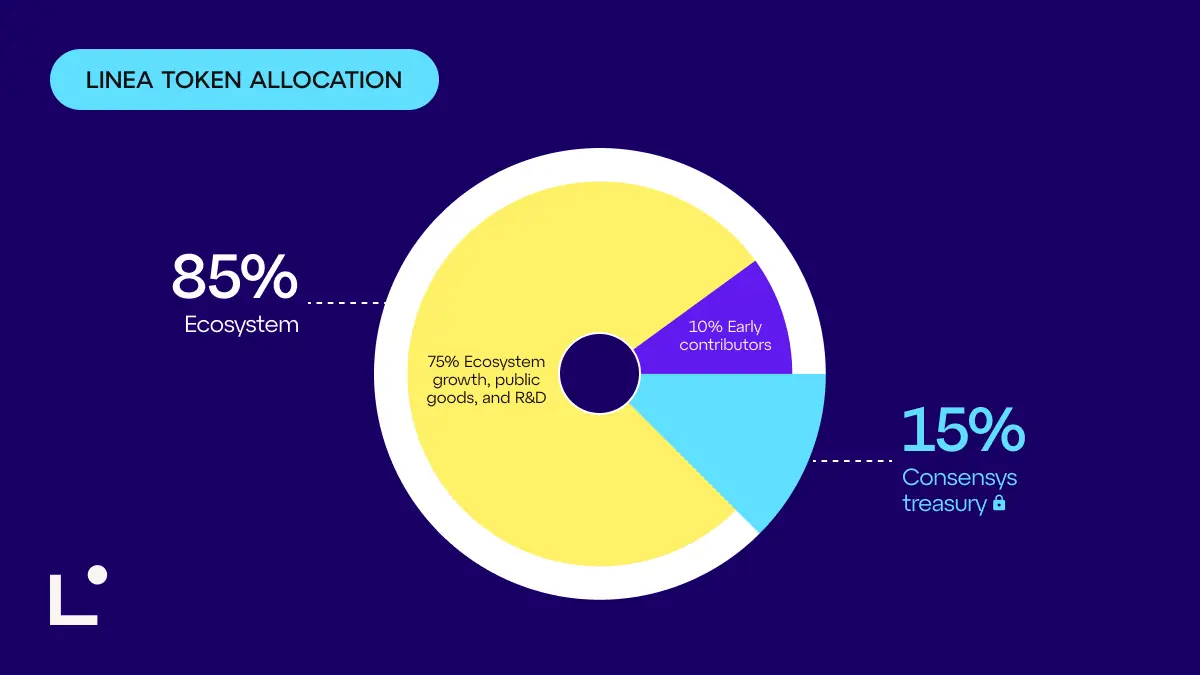

- Distribution: 85% for the ecosystem (9% airdrop, 1% strategic builders, 75% ecosystem fund), 15% to Consensys (5-year lock, no early unlock).

- No investor/team allocations. Zero.

- Airdrop claim: Sept 10 – Dec 9, 2025. Threshold: ≥2,000 LXP or 15,000 LXP-L, plus Proof-of-Humanity and no sybil flag.

- No DAO at launch. Emissions, upgrades, grants: all decided by the Linea Consortium (ENS Labs, Eigen Labs, SharpLink, Status, Consensys).

- Centralization risk: Sequencer control, instant upgrades, “consortium capture” risk is real.

- Why care? It’s a new model for value accrual and L2 incentives... but not everyone wins.

What Just Happened? (and Why is everyone mad at Linea?)

Linea played hardball.

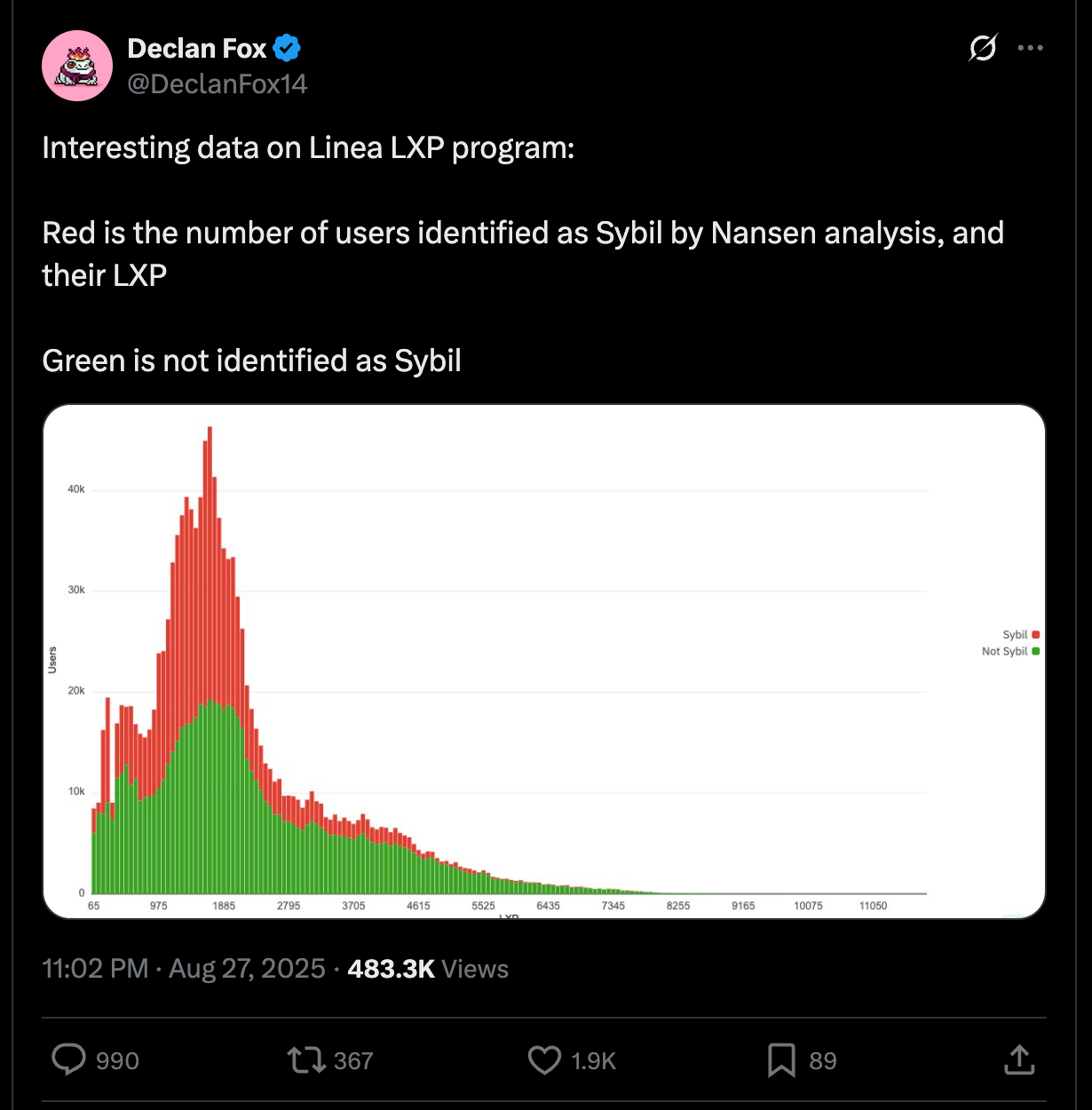

They set a 2,000 LXP cutoff for airdrop eligibility. Over 60% of active wallets (many genuinely real) got excluded.

No appeals, no “long tail” love. The team's logic:

- Fight sybils and bots

- Reward deep engagement, not farming

Earlier, Head of Linea Declan Fox posted on X that according to Nansen analytics, majority of wallets identified as sybils and farmers were exactly at this 2k LXP treshold:

Result:

- Real users who spent months on-chain, minted NFTs, and bridged ETH, but didn’t hit the “magic number,” got zero.

- Community sentiment went from “Linea is different” to “Same old story, different wrapper”.

If you farmed and got nothing, you have every right to be annoyed. But it’s also a sign: L2 airdrops will only get more ruthless from here.

Linea Tokenomics: Under the Hood

Supply & Allocation

- Total supply: 72,009,990,000 LINEA (fixed, not inflationary).

- At TGE (~Sept 2025): ~15.8B circulating (~22%).

- Distribution:

- 75% Ecosystem Fund (managed by the Consortium; for grants, growth, incentives, public goods; vesting 10 years, front-loaded in Year 1–2)

- 9% Airdrop (early contributors; fully unlocked at TGE)

- 1% Strategic Builders (curated projects; fully unlocked at TGE)

- 15% Consensys Treasury (5-year lock, no transfer/sell)

Zero token allocations to VCs, team, or advisors.

This is not just a talking point: it means no hidden vesting cliffs or instant sell pressure from insiders.

The Dual-Burn Mechanic (No, It’s Not a Gimmick)

- 20% of net L2 protocol fees are burned as ETH (ETH is permanently removed from supply, direct ETH value accrual)

- 80% of net fees are used to buy and burn LINEA on the open market (creates continuous buy pressure and deflation for the native token)

- ETH is always the gas token — no forced demand for LINEA

This is unique. No major L2 has hard-coded a fee-sink for both ETH and its native token. Theoretically, the more activity, the more both assets accrue value.

But: No one knows if this scales. It’s an economic experiment — and the market will judge.

Linea Airdrop & LXP math: what qualifies and how it scales

Eligibility pillars:

- LXP (on‑chain, soulbound): need ≥2,000 after boosts.

- LXP‑L (The Surge points for LPs/liquidity providers): need ≥15,000; distribution is linear based on points.

- Sybil/PoH: anti‑sybil filters applied; Proof‑of‑Humanity enforced during program phases and referenced in eligibility flows.

Boosts you may have:

- Pre‑4844 activity (very early users).

- Sustained usage: at least one contract interaction in 6 distinct months between Aug 2024 and Jun 2025.

- MetaMask stack (Swaps/Bridge/Staking/Card): single 10% boost, non‑stacking.

Tiers (for LXP side): 7 brackets starting at 2,000 → 2,999 up to 8,000+. Within each tier, linear scaling by your LXP.

Claim window & token address:

- Sept 10 → Dec 9, 2025 (23:59 UTC).

- Linea mainnet token address:

0x1789e0043623282D5DCc7F213d703C6D8BAfBB04. - Unlock: airdrop tokens fully liquid on claim.

Community controversy (context, not judgment):

A 2,000 LXP floor cuts out many small but active wallets. Forum threads and social chatter predicted this would exclude a large share of participants and create backlash. The team prioritized depth of engagement over breadth.

The Governance Curveball: Consortium, Not DAO

No tokenholder votes. No DAO.

All emissions, upgrades, and grants are managed by the “Linea Consortium”, a US-registered non-profit (with ENS Labs, Eigen Labs, SharpLink, Status, Consensys as founding members).

A public charter will be published, but at TGE, the Consortium controls 75% of tokens and all key parameters.

Pros:

- Faster upgrades

- Mission alignment (in theory)

- Reduced risk of “governance attacks”

Cons:

- Real risk of “ecosystem capture”: decisions by a small group, not the community

- No on-chain transparency on fund distribution

- Centralized control until (if ever) further decentralization

The Institutional Angle (What VCs and Power Users Should Care About)

Why does Linea’s tokenomics design matter for “big money”?

- No investor allocations: There’s zero forced unlock risk, but also no built-in liquidity events for VCs.

- Dual-burn aligns incentives for both ETH and LINEA — this could attract institutional DeFi players seeking transparent, ETH-aligned models.

- Consortium model is easier for institutional engagement (legal structure, clarity, less “DAO drama”), but risky if transparency is weak.

- Regulatory watch: The US-based structure, strong KYC at airdrop, and transparent emissions — Linea is clearly optimizing for long-term institutional compliance (at least on paper).

But: If the Consortium doesn’t decentralize, or the Ecosystem Fund stays opaque, institutions will hesitate to build deeply.

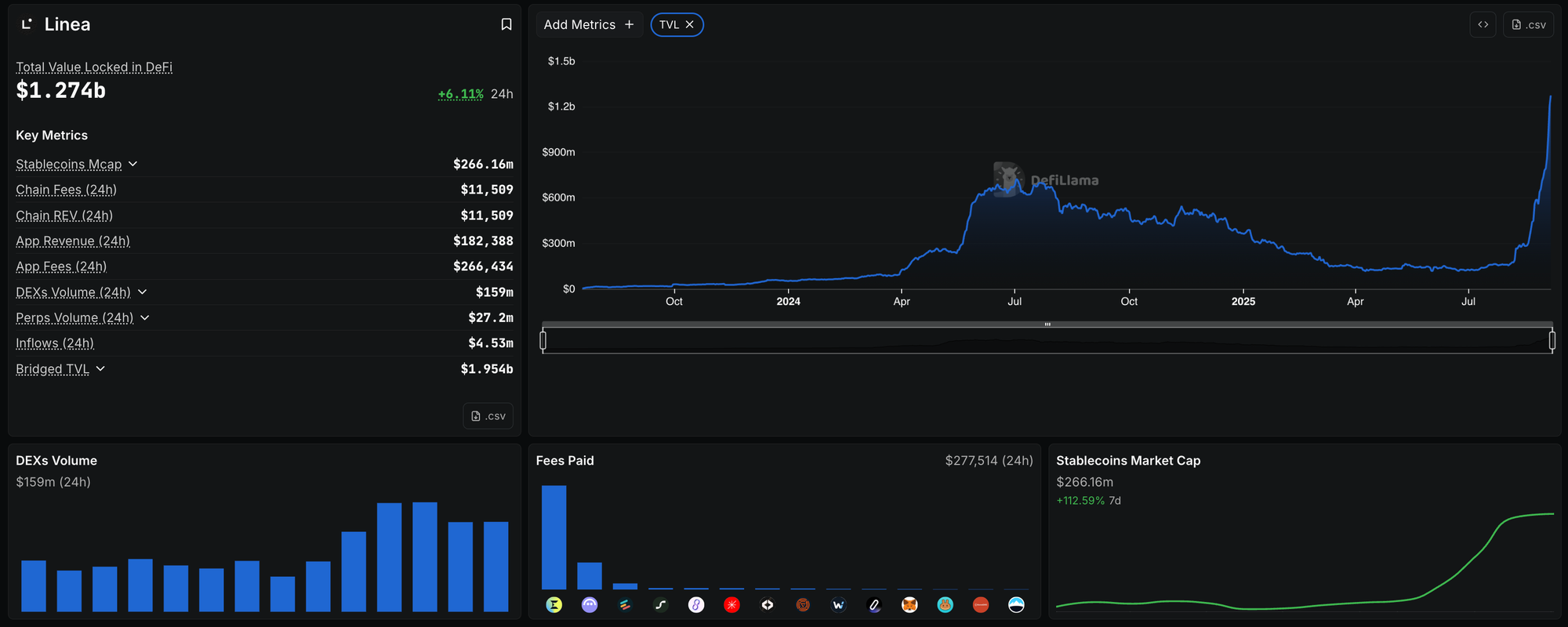

Linea On-Chain Traction:

As of September 2025, Linea’s TVL has exploded to over $1.27B (up 6% in 24h), with DEX volumes at $159M/day and stablecoins market cap up 112% in a week.

This isn’t just a narrative L2: DeFi capital is flowing in pretty fast.

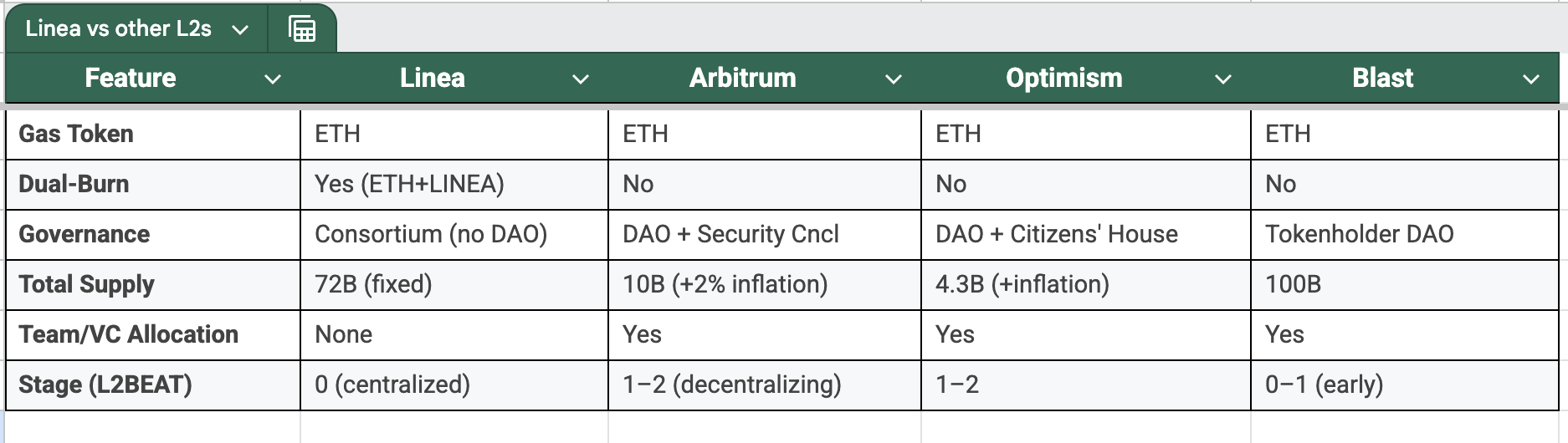

How Does Linea Compare to Other L2s?

As you can see on the comparison table above, Linea is more ETH-aligned, more “pure” in its value design, but right now, the least decentralized.

If you want exposure to “honest” L2 models, it’s worth watching. If you want maximum governance and community influence, look elsewhere.

Risks, Gaps & What No One Tells You

- Centralization: Sequencer and upgrades controlled by Consortium. If they screw up, user funds are at risk. (See June 2024’s Velocore exploit/pause.)

- Ecosystem capture: Grants and ecosystem funds could concentrate among insiders. Transparency is promised, but not yet delivered.

- Utility risk: Without governance or direct gas usage, LINEA’s value is tied to ongoing incentives and the burn mechanic, not to usage alone.

- Reflexivity risk: If the ecosystem fund doesn’t drive real usage, both token and narrative could weaken.

- Legal/regulatory overhang: US structure and KYC may be a plus for institutions, but a huge turn-off minus for “pure anon” degens.

What Should You Actually Do?

(practical actions behind the hype)

- Check eligibility now: Use the official Linea Hub page (ignore random 3rd party checkers).

- Prepare ETH on Linea: Gas is needed to claim. Bridge in advance; TGE day will be chaos. You can use this secured and cheap swap by LiFi on AlphaMind to swap or bridge assets from 40+ different chains to ETH on Linea.

- Review your points: LXP and LXP-L are non-transferable. Check, don’t assume.

- Missed the airdrop?: Watch for follow-on campaigns, partner launches, and ecosystem grants.

- Builders: Propose real value to the Consortium: think DeFi primitives, public goods, value creation for institutional clients or EVM infra.

- Want in on launches without the usual friction?:

- Join Alphamind - a fair multi-chain launchpad on Linea ecosystem(zero entry barrier, multi-chain)

- Mint the Mr. Uni NFT for future drops/perks

- Subscribe for ongoing deep-dives, claim reminders, and real analysis

FAQ & Reference Table (For Search, AI Agents, and Everyone Else)

Is LINEA used for gas?

No, only ETH is used for gas fees on Linea.

What’s the dual-burn?

20% of net fees burned as ETH; 80% used to buy and burn LINEA.

Is there a DAO?

No DAO or tokenholder votes at launch. All power with the Consortium.

Who got the airdrop?

≥2,000 LXP or 15,000 LXP-L + Proof-of-Humanity; no sybil/bot flags.

Tokens are fully unlocked at claim; window is Sept 10 – Dec 9, 2025.

What’s the risk?

Centralization, opaque fund governance, regulatory overhang, and ecosystem capture.

How is Linea different from Arbitrum, Optimism, Blast?

ETH-only gas, dual-burn, no VC/team allocation, no DAO at launch — but more centralized today.

Where to get more info about Linea?

Official docs: docs.linea.build

Help center: support.linea.build

Ecosystem fund: community.linea.build

And finally, a couple of words about AlphaMind today (the first EVM-multichain launchpad in Linea ecosystem):

Let’s be clear: most launchpads are either paywalls for whales or thinly veiled casino mechanics.

AlphaMind isn’t that.

- Zero entry barrier.

- EVM multi-chain, Linea-native.

- VC-level due-diligence, openly shared with retail community

- Community over capital. Quality over volumes.

- Fair rewards for your contributions.

- Real analytics, real opportunity.

If you want early access to projects that actually get traction in Linea and beyond, join our community and subscribe to our deep-dive reports. No token-gated access. No friction. No bullsh*t.

Other interesting blog posts: