Gold Down 10%, Silver Down 33%, Crypto Wiped Out: What Really Happened

Gold, silver and crypto sold off together — not because “the story changed overnight,” but because leverage met thin liquidity. A plain-English breakdown of what happened and what to watch next.

Author: Hima Eltegany

When markets get stressed, the story usually sounds simple: “Bad news hit the tape.”

But the last sell-off didn’t feel simple. Gold dropped hard, silver got absolutely wrecked, and crypto followed with violent liquidations - all at the same time.

If you’re a retail investor, the important question isn’t who said what on TV. It’s what happens to price when liquidity disappears and leverage gets forced out.

This article breaks the move down in plain English: what we know, what we don’t, and what to watch next.

1) The headline trigger was political. The real driver was mechanical.

Several major outlets linked the precious-metals sell-off to President Trump’s nomination of Kevin Warsh as the next Fed chair - interpreted as a more hawkish stance, a stronger dollar bias, and less tolerance for inflation.

That can move markets.

But a move of this magnitude across multiple asset classes usually needs something else:

- Crowded positioning (too many people on the same side)

- Thin liquidity (not enough real buyers underneath)

- Leverage (borrowed money amplifying small moves)

- Forced selling (margin calls and liquidations)

When those four line up, price stops being a “poll” of opinions and turns into plumbing.

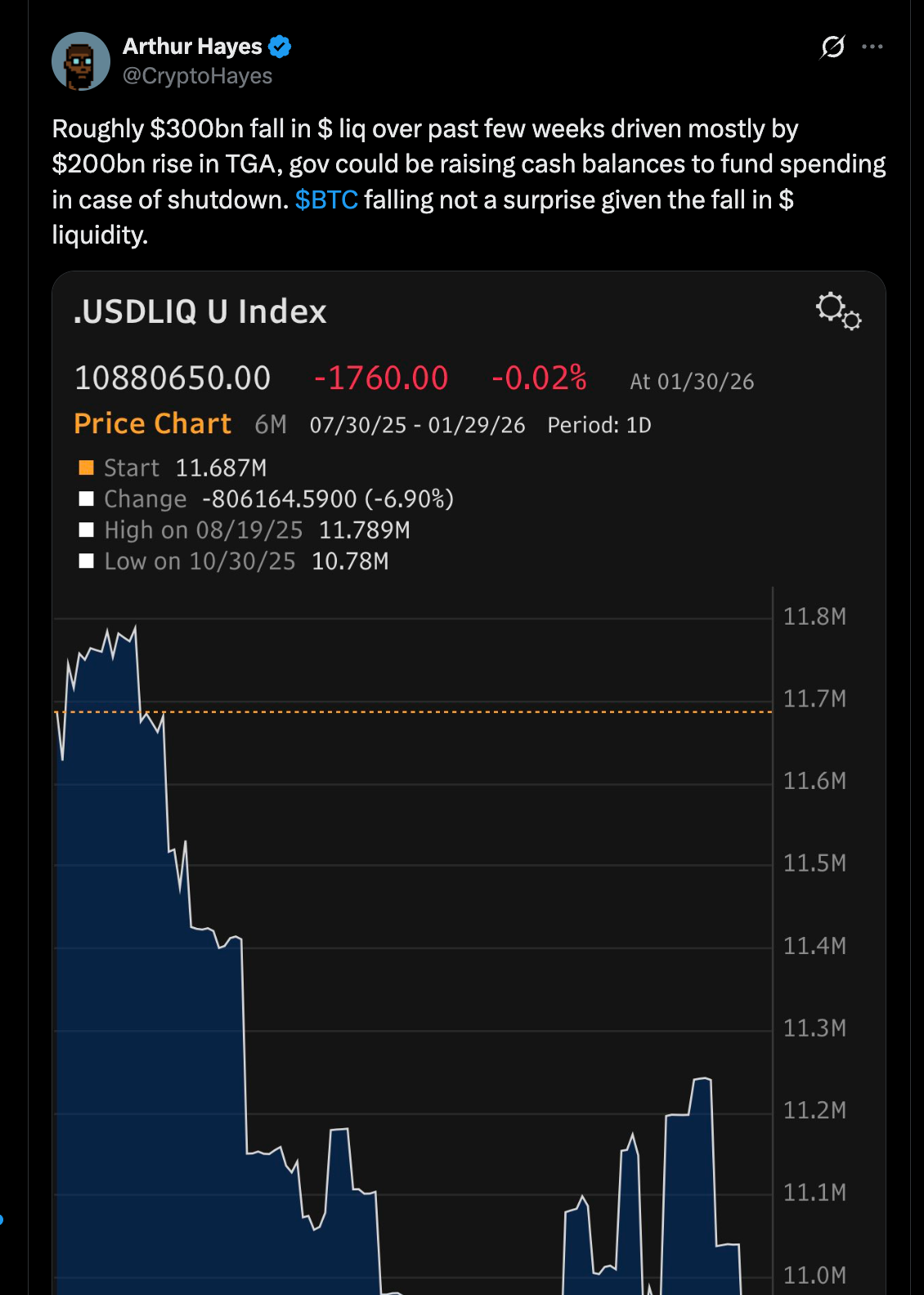

A useful way to frame moves like this is liquidity first, narratives second. Arthur Hayes (BitMEX co-founder) pointed out that the real pressure comes when dollar liquidity contracts - and crowded, leveraged trades stop having a bid underneath them. In other words: the story may start the move, but liquidity decides how ugly it gets.

2) Silver didn’t “panic” - it got liquidated

Silver had become a momentum trade.

When it started rolling over, the selling wasn’t just “people changing their mind.” A big part of it was positions getting closed automatically.

Here’s the chain reaction retail tends to underestimate:

- Price starts falling.

- Exchanges raise margin requirements (you need more collateral to hold the same position).

- Traders get margin called.

- Traders who can’t top up collateral get liquidated.

- Liquidations push price lower.

- Lower price triggers more liquidations.

That loop can turn a normal pullback into a collapse.

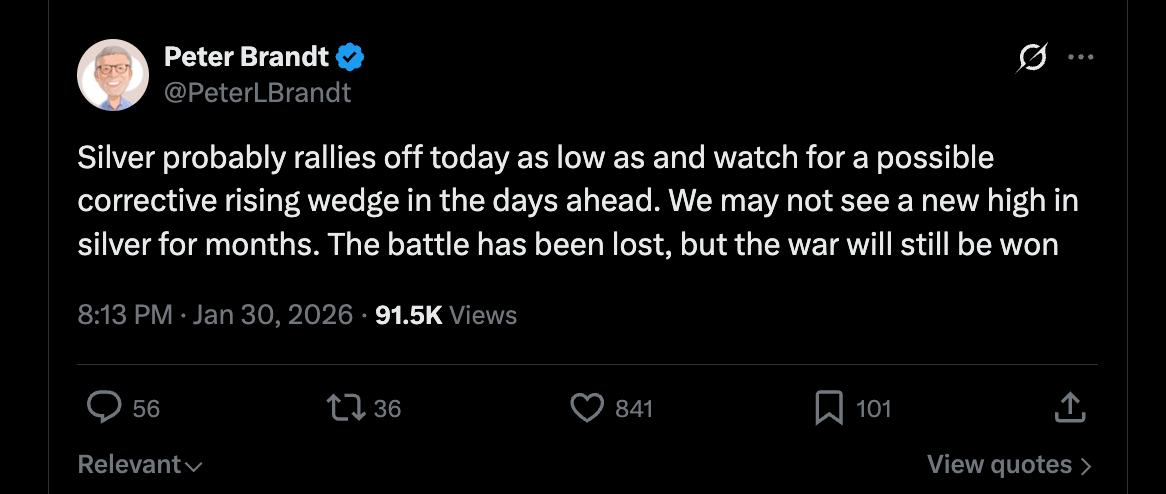

After margin-driven flushes, markets often overshoot. Even veteran traders who were bearish on silver started talking about a short-term bounce once the drop got extreme - not because the long-term story changed overnight, but because positioning got forcibly reset.

3) “Paper” vs “physical” silver: real structure, lots of noise

Whenever silver moves violently, a familiar debate returns: paper markets (futures/derivatives) vs physical supply.

Two things can be true at once:

- It’s true that derivatives markets can represent far more “silver exposure” than physical metal available for delivery.

- It’s also true that most of the time the market functions without a dramatic delivery crisis.

What’s dangerous for retail is when the debate turns into certainty:

- “This proves manipulation.”

- “The price is fake.”

- “It’s guaranteed to snap back.”

Sometimes there is manipulation.

But the practical takeaway is simpler:

In stress events, paper markets can move violently because leverage and margin rules matter more than slow, real-world supply dynamics.

If you’re trading derivatives, you are trading the rules of the venue as much as you’re trading the metal.

4) Gold can fall during a liquidity crunch (and still be a hedge long-term)

People treat gold as a “safe haven,” so when gold sells off, it feels like the thesis broke.

In reality, the first phase of a liquidity event often looks like this:

- everything gets sold to raise cash,

- positions get cut to reduce risk,

- and even “defensive” assets drop.

Then, if the stress persists, the market often re-prices what’s truly scarce and what has counterparty risk.

That’s why you can see gold sell off first and recover later — because the first trade is about cash and survival.

Source reading (optional): Barron’s on the initial slump and rebound: https://www.barrons.com/articles/gold-price-silver-rally-fed-4be3fd95

5) Crypto didn’t cause the move — it amplified it

Crypto is the purest “liquidity beta” asset class:

- high leverage,

- 24/7 trading,

- lots of derivatives,

- and fast liquidation engines.

So when global risk gets cut, crypto tends to move first and hardest.

Reuters reported about $2.5B in crypto liquidations during the volatility spike — a clear sign that forced selling (not just sentiment) played a major role.

The speed of the drop matters because it’s exactly what liquidation engines are built for. Galaxy Digital’s Head of Research Alex Thorn summarized it bluntly on X: a ~15% slide in just a few days, with a huge wave of forced long liquidations. That’s not “investors changing their minds” - that’s positions getting closed automatically.

Saturday alone saw a 10% move that spurred one of the largest liquidation events in history, with more than $2 billion in long liquidations across futures trading venues. The price action brought bitcoin down ~15% in just a few days, with a huge wave of forced long liquidations... The speed of the drop matters because it’s exactly what liquidation engines are built for.

6) Why retail usually gets hit the hardest

Retail doesn’t lose because retail is “dumb.” Retail loses because retail has less flexibility.

In a fast market:

- exchanges raise margins,

- spreads widen,

- stops get hunted,

- liquidity evaporates,

- and the liquidation engine doesn’t negotiate.

Institutions can post collateral, roll exposure, hedge, or wait.

Retail often can’t.

So “my thesis is right” isn’t enough. Position sizing and leverage decide who survives.

7) What to watch next (without pretending to predict)

Nobody can reliably call the bottom from a single red candle.

But after a forced unwind, a few signals matter more than price headlines:

- Does volatility keep rising, or start compressing?

- Do funding rates / open interest rebuild immediately (danger), or reset (healthier)?

- Do metals stabilize without new margin shocks?

- Do risk assets start moving independently again (correlations break down)?

If everything keeps moving together, the system is still de-leveraging.

A simple risk note

This is not financial advice.

The core lesson of weeks like this is boring but useful:

- leverage works until it doesn’t,

- “safe” doesn’t mean “never down,”

- and survival comes before opportunity.

If you want to stay close to the market (without noise)

We run AlphaMind as a community where we try to stay adult about risk - no guaranteed returns, no hype, just the mechanics and real-time context.

- Telegram: https://t.me/alphamind_official

- Discord: https://discord.gg/NB4hhuXkWz

And if you want something actionable (not just reading), check our meaningful quests for smart crypto dudes - sometimes you can earn rewards, sometimes it’s simply a good way to learn a project and see what’s building:

- Quests hub: https://app.alphamind.co/build_karma