Crypto Narratives 2026: What Retail Actually Cares About (After a Weird 2025)

2025 felt like narrative fatigue. This AlphaMind research maps the crypto narratives that actually matter for retail in 2026 - from RWAs and AI x DePIN to prediction markets, TON and stablecoins.

Written from the trenches by the AlphaMind launchpad team & our slightly traumatized retail bags.

If 2025 felt weird to you as a crypto investor, you are not alone.

Yes, we had:

- an AI season that started hot and then drifted into a blur of half‑baked “AI + token” pitches,

- a memecoin overdose, where everything pumped for two days and then rugged in slow motion,

- a few waves in restaking, DePIN, Telegram games, RWAs…

…but compared to earlier cycles, there was no single meta that carried the whole year. Most so‑called narratives felt like short TikTok trends: loud for a week, dead the next.

As a fair, non‑refundable launchpad, at AlphaMind we see both sides:

- retail chats asking every week: “What’s the next big narrative for 2026? Where do we even look?”

- founders and VCs quietly admitting: “Narratives aren’t free alpha anymore. You actually need substance.”

So instead of inventing predictions out of thin air, we did the boring but useful thing:

- read recent institutional reports (BCG, Binance Research, McKinsey, Coinbase, etc.),

- dug into RWA and stablecoin data,

- scanned Crypto Twitter / CT, including threads surfaced via Grok AI and NotebookLM,

- looked at what funds, exchanges, and protocol leads are actually building and funding.

Below is a retail‑first map of 2026 narratives: what’s real, what’s pure hopium, and where a launchpad like AlphaMind will actually be hunting for deals.

How We Researched 2026 Crypto Narratives

We did not just scroll a few CT threads and call it “research”.

For this article we:

- read late-2025 outlooks from top funds and research desks (Top VC firms in crypto including Coinbase Ventures, large trading firms, institutional reports);

- looked at real data around RWA, AI × crypto, DePIN, restaking, stablecoins, gaming, prediction markets;

- used tools like NotebookLM Deep Research and Grok to scan Crypto Twitter, blogs, Substacks and fund letters;

- cross-checked all of that against what we see internally on AlphaMind: which pitches we get, what performs after TGE, what our community actually asks about;

- and matched it all with what we saw this year on InnMind: which projects get the most intro requests from investors, who closes deals and gets checks from VCs.

The result is not a list of buzzwords. It is a map of where serious people (industry insiders) expect attention and capital to go in 2026, plus our view as a launchpad that has to live with the consequences.

TL;DR for Impatient Degens

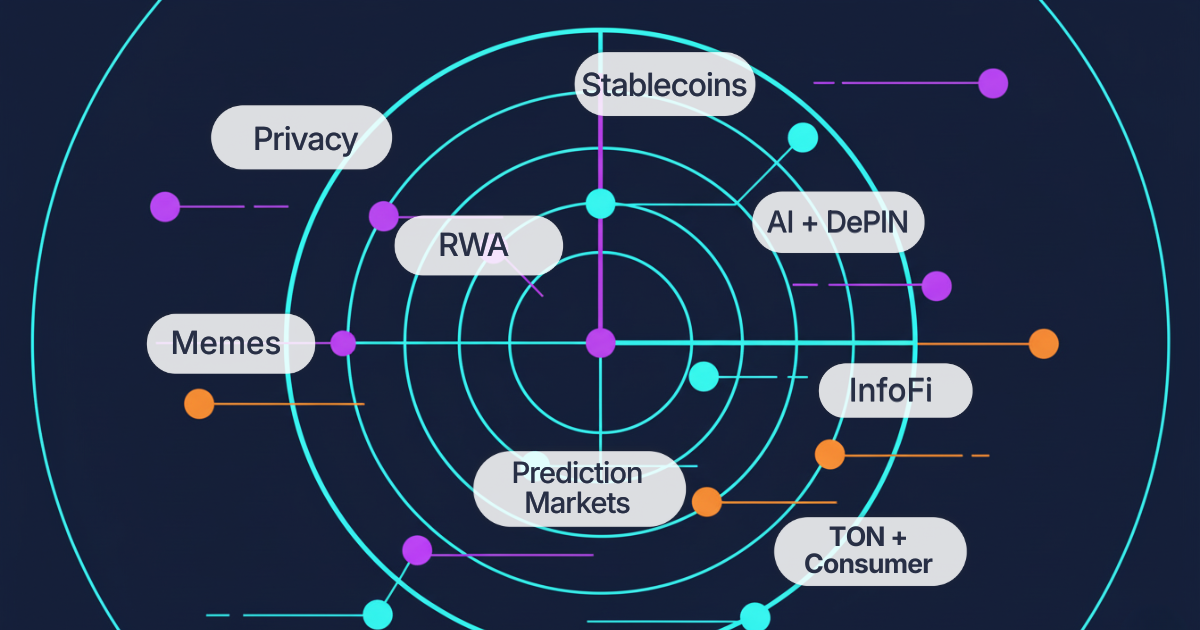

If you don’t want the full long read essay, here’s the short version of what looks real for 2026:

- RWAs & on‑chain funds – not sexy, but the most serious capital is moving here. Think BlackRock BUIDL, Franklin Templeton’s Benji, tokenized treasuries.

- AI x Crypto + DePIN – AI compute, storage, and data markets that are actually cheaper or more open than Web2 clouds (Akash, Bittensor, Gensyn‑style plays).

- Prediction markets & InfoFi – Polymarket, on‑chain odds as an oracle for reality, Vitalik’s “access to uncensored information” theme.

- Consumer crypto on Telegram & TON – Telegram mini‑apps, quasi‑Web2 UX, hidden DeFi rails under memecoins and games.

- Modular infra, restaking, security as a service – EigenLayer‑inspired “rentable trust” and L2/L3 Lego for everything.

- Privacy, proofs of humanity & anti‑Sybil – systems that bring just enough identity for real finance and governance.

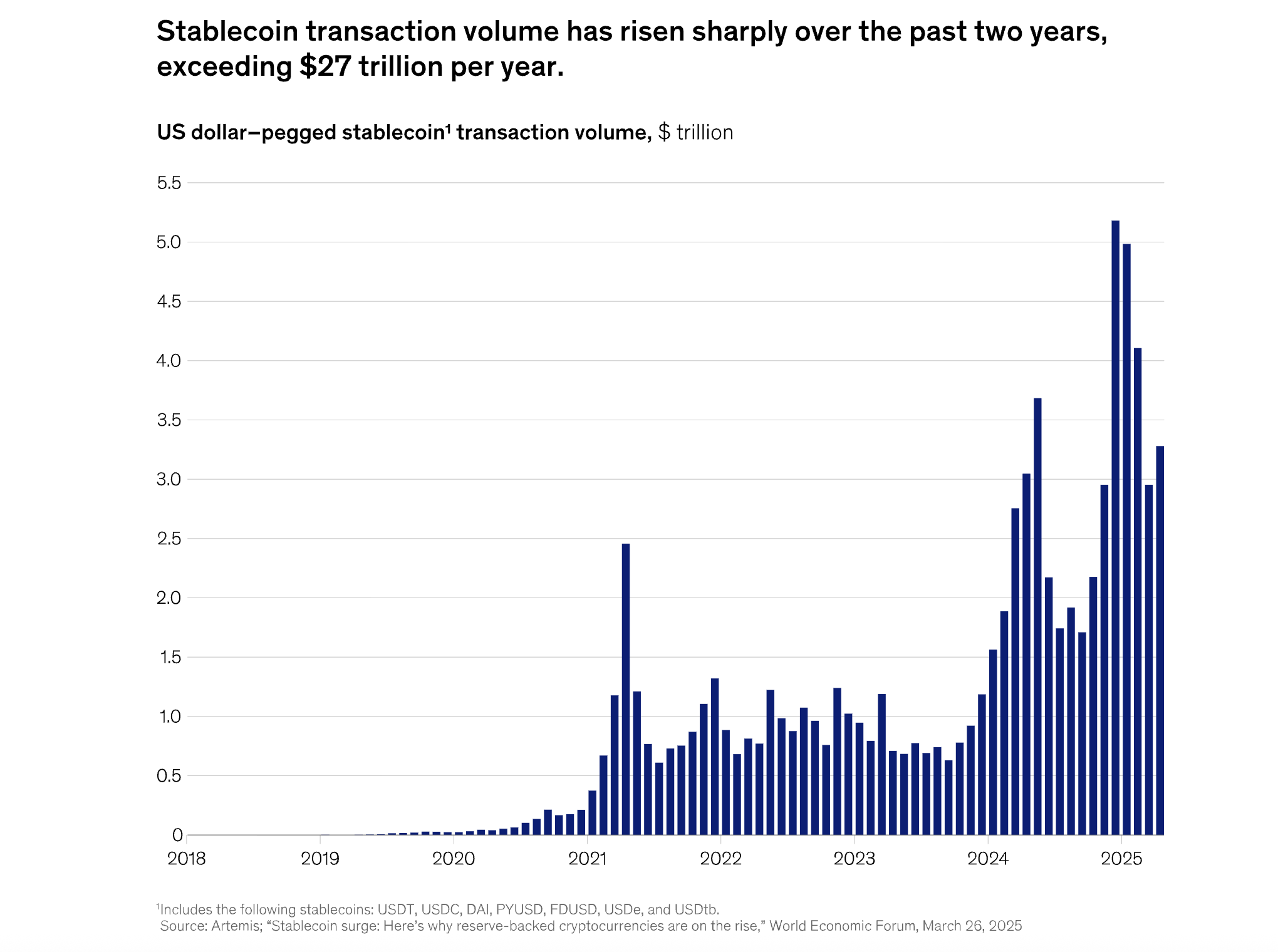

- Stablecoins, perps and institutional DeFi – boring but huge: 27+ trillion in stablecoin flows beating Visa/Mastercard.

Memecoins, of course, aren’t going anywhere – but they’re more like the weather: permanent, chaotic, and mostly impossible to “plan a thesis” around.

Let’s unpack.

RWAs & Tokenized Funds: From Narrative to Default Rail

For years, “RWAs” (real‑world assets) were a conference buzzword. In 2025 they quietly turned into something else: actual product with actual AUM.

- BlackRock’s BUIDL tokenized treasury fund crossed around $1.7B in AUM and expanded to Solana and other chains, becoming one of the largest on‑chain funds in existence.

- Franklin Templeton keeps scaling the Franklin OnChain U.S. Government Money Fund (BENJI), including new structures in Europe.

- A joint BCG + Ripple report projects tokenized assets (including stablecoins and tokenized deposits) reaching $18.9T by 2033.

- Larry Fink keeps calling tokenization “the next generation of markets”.

This isn’t a meme season. This is TradFi quietly deciding that blockchains are cheaper rails for cash‑like products.

What RWA narrative actually means for retail

Upside:

- RWAs turn crypto from “casino” into infrastructure for money markets, credit, and funds.

- On‑chain dollars and funds become the base layer for everything else (perps, structured products, consumer apps).

Risks / traps:

- 99% of “RWA” tokens are not BlackRock. Many are just rebadged DeFi with off‑chain legal promises you’ll never read.

- Chain risk matters: if your “tokenized T‑bills” live on a random L2 with three nodes, that’s not the same as US Treasuries.

How AlphaMind will treat RWA projects in 2026

On AlphaMind we’re not trying to launch “the 57th RWA meme wrapper”. If we list an RWA or tokenized‑fund project, we’ll be asking:

- Is there a regulated entity and real AUM behind the token?

- What exactly does the token represent in legal terms?

- Why does this need a token sale, vs just growing AUM and fees?

If we don’t see hard answers, we’d rather skip the deal than sell “fake RWAs” to our community.

AI x Crypto & DePIN: Beyond Putting “AI” in the Ticker

The AI + crypto meta in early 2025 was mostly cringe: many projects just added “AI” to a regular DeFi protocol and called it a day.

But underneath the noise, a serious track emerged: decentralized physical infrastructure networks (DePIN) for compute, storage, and data.

- Akash Network keeps pushing decentralized GPU markets, proudly marketing up to ~80% cheaper compute compared to AWS‑style clouds.

- Networks like Bittensor and Gensyn experiment with incentives for AI models and training.

- AI‑heavy reports by Binance Research and others now treat “AI infra + DePIN” as a serious structural theme, not just speculation.

For retail, what’s the actual opportunity?

The winners here are likely to be:

- projects that really make AI compute cheaper or more censorship‑resistant,

- infra where AI agents can pay each other with stablecoins or native gas,

- DePIN networks with non‑zero real world revenue, not just token emissions.

Red flags:

- no clear reason why this needs to be decentralized,

- zero paying customers, but a very detailed “AI x Web3 x metaverse x DePIN” deck.

How we approach AI x DePIN on AlphaMind

Our internal checklist for this vertical looks roughly like:

- Show us live demand – even if tiny. Who is renting your compute / data today?

- Show us unit economics – is this just subsidized GPU mining with a token, or does it work without emissions?

- Show us moat – why can’t a CEX or a hyperscaler crush your margin in 6 months?

We’d rather do one serious AI x DePIN sale than ten “AI narrative” tokens that only pump on announcements.

Prediction Markets & InfoFi: Pricing Reality in Real Time

One of the strongest themes in our research is the rise of prediction markets as an information layer.

- Polymarket went from niche degen toy to being treated seriously by Wall Street after the ICE / NYSE parent announced plans to invest up to $2B at an $8B valuation.

- Vitalik has been talking more and more about “access to high‑quality, uncensored information” as a critical crypto use case. In his late‑2025 tweet he highlights two projects focused on censorship‑resistant information flows (and donated them 128 ETH).

- Many influential CT accounts keep framing prediction markets as “InfoFi” – an oracle about what people with skin in the game actually believe.

Why this matters

A running theme across 2025 research: information itself becomes a financial primitive.

- Markets price probabilities (election outcomes, macro data, protocol launches).

- Apps and even traders start using market odds as a live oracle.

- If you care about narratives, these markets are literally pricing narratives vs reality.

What we’ll watch as a launchpad

We’re not going to list the next 500 “Polymarket clones”. What’s interesting:

- protocols that plug prediction markets into risk engines, funding rates, insurance,

- tooling that makes retail access to these markets legal and usable, not just VPN + metamask roulette,

- infra layers that push Vitalik’s “uncensored information” narrative into real‑world usage.

That means on AlphaMind we’ll evaluate whether a project:

- is building something on top of prediction markets (data, tooling, integration),

- or is “just another front‑end” wrapped in a token.

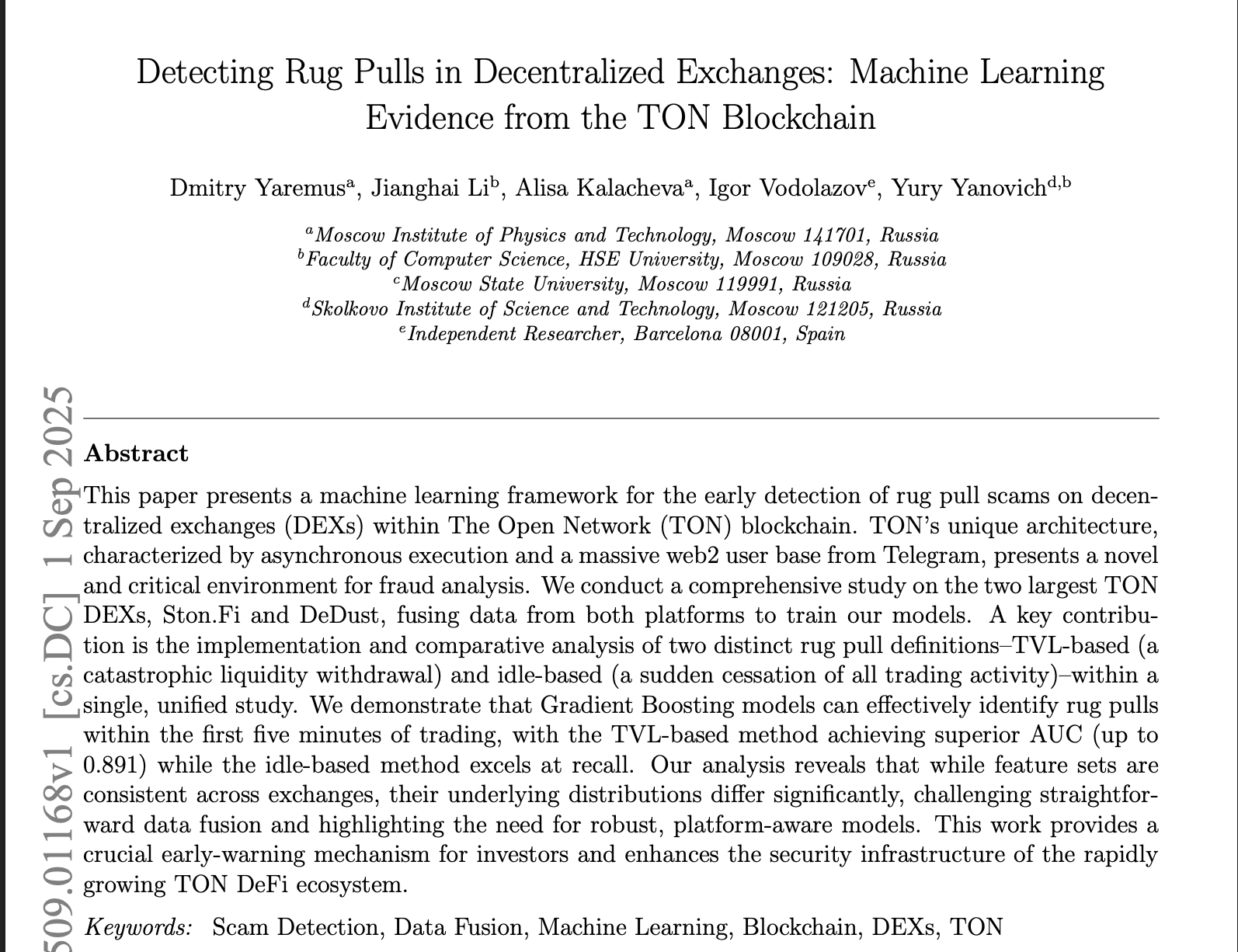

Consumer Crypto on Telegram & TON: Mini‑Apps, Max Adoption

If 2024-2025 were the trial run for TON, 2026 is where it either becomes the default consumer blockchain – or proves the skeptics right.

Signals so far:

- Telegram’s founder Pavel Durov is openly positioning mini‑apps + TON as a new app distribution layer inside chats.

- TON ecosystem reports show hundreds of dApps and 200+ tokens, with DeFi TVL crossing $150M+ and growing.

- Analyses from Binance Research, BingX and others note that TON + Telegram mini‑apps are now a serious chapter in consumer crypto, not just a curiosity.

- Multiple TON ecosystem overviews now frame Telegram + TON mini‑apps as one of the strongest consumer on‑ramps for the next cycle, especially for users who have never touched a browser wallet before.

The opportunity (and danger) for retail

- On the plus side: UX finally looks like Web2. Users tap a bot, play a game, and accidentally find themselves with a wallet.

- On the minus side: the same UX makes it trivial to funnel millions of normies into scams and low‑effort memecoins.

TON is already attracting serious academic work on rug‑pull detection because the rug meta is that bad.

AlphaMind’s stance on TON/Telegram narratives

We’re not going to treat “is on TON” as a magic stamp of quality.

For any TON / mini‑app / Telegram‑native project, questions we’ll obsess over:

- What is the actual retention and monetization beyond a viral on‑chain game?

- Is there defensible product if the tap‑to‑earn meta dies (which multiple TON analysts already predict)?

- How does the token capture value if Telegram changes policies or fees?

For our community, we’ll also keep publishing practical safety guides on:

- how to avoid Telegram‑based scams,

- how to evaluate TON memecoins and games beyond “it’s pumping on CT”.

Modular Infra, Restaking & Security as a Service

Restaking, shared security, rollup‑as‑a‑service, “L3 for everything” – by 2025, many retail investors just mentally filed this under “dev stuff, wake me up when number go up”.

But if you read the 2025 market structure reports from Binance Research, Coinbase, and others, you see a pattern: all serious infra narratives now connect back to one simple question – who secures what, and who gets paid for it?

Key themes for 2026:

- Restaking and shared security turning into a wholesale market for trust.

- L2s and app‑chains needing clean stories on security, data availability, and MEV.

- Infra tokens that behave less like lottery tickets and more like yield‑bearing infrastructure equity.

What this means for deals on a launchpad

Infra tokens can be amazing – if:

- revenue is real,

- security assumptions are clear,

- the token is not just a thin wrapper on “we raised at FDV $5B, please buy the exit liquidity”.

When AlphaMind evaluates infra / restaking deals in 2026, our DD will focus heavily on:

- who pays whom, and in what asset,

- how sustainable the yield is without token incentives,

- what happens in a stress event (chain reorg, L2 downtime, governance failure).

If the answers are vague, we’d rather keep infra narratives as a topic for blog posts than for sales.

Privacy, Proof‑of‑Humanity & Anti‑Sybil

By late 2025, a weird consensus formed across VCs, protocol devs and CT analysts:

“We’re not getting serious consumer or institutional adoption without some layer of identity and spam control – but people still hate KYC.”

So one of the quiet but strong narratives for 2026 is “just‑enough identity”:

- proofs that you’re a unique human (not 500 bots),

- proofs that you’re from a certain country / segment without doxxing your life,

- reputation trails that can survive across wallets and chains.

This connects directly to:

- airdrop farming fatigue – protocols want real users,

- governance capture – DAOs being botted to death,

- regulators wanting some line between “anonymous casino” and “completely surveilled finance”.

How this hits retail

For investors, the ugly but realistic expectation:

- a lot of “anonymous, no‑KYC, ape‑from‑anywhere” UX will slowly shrink,

- projects that solve anti‑Sybil and identity in a user‑friendly way can be some of the most valuable infra of the next cycle.

From an AlphaMind perspective, we’ll be looking for:

- privacy‑preserving identity tooling that doesn’t kill UX,

- projects where token value is clearly linked to adoption of these identity / reputation systems,

- teams that understand the regulatory minefield enough not to rug their own users via compliance mistakes.

7. Stablecoins, Perps & Institutional DeFi: The Boring Super‑Narrative

While CT was arguing about memecoins, stablecoins quietly went crazy:

- In 2024, on‑chain stablecoin transfer volume hit $27.6T, surpassing Visa and Mastercard combined according to multiple analyses.

- 2025 reports from McKinsey and others treat tokenized cash and stablecoins as core to next‑gen payments, not as a side quest.

Put simply: the biggest real‑world narrative in crypto is “dollars that move better”.

On top of that you have:

- perpetuals and derivatives protocols slowly converging to CEX‑level UX,

- institutional DeFi that borrows CeFi’s best parts (KYC pools, segregated vaults, compliance rails) while keeping on‑chain transparency.

What this means in practice

For retail, this looks like:

- more ways to earn yield on dollars with varying trust assumptions,

- perps and options platforms that are almost indistinguishable from a CEX,

- but also more risk of “fake yield” dressed up as RWAs or stablecoin strategies.

For AlphaMind, in 2026 we’ll be very picky with projects that:

- advertise double‑digit USD yields without clear source of returns,

- play buzzword bingo with “RWA, stablecoin, insured, KYC’d” but have no audited structure.

We’d rather under‑promise on yield than repeat the 2022–2023 “CeFi collapse” meta.

And What About Memecoins?

Let’s be honest: memecoins will always be a meta.

TON, Solana, Base, whatever L2 you like – each will have:

- its own seasonal casino,

- its own 100x screenshots and 99% drawdowns,

- its own subculture of CT accounts you’ve never heard of.

From our research, memecoins aren’t going away. If anything, they’re evolving:

- more “branded” memes (KOLs, celebrities, political figures),

- more platform‑native memes (TON, Telegram, mini‑apps),

- more explicit blend of gambling + social + leverage.

As a fair, non‑refundable launchpad, our room to play here is limited by basic ethics:

- If a “project” is literally a meme, with no pretense of product and no treasury plan, it’s a bad fit for AlphaMind.

- Where we might engage is in educational content, tools, and frameworks that help retail:

- understand meme cycles,

- not over‑allocate to pure lotto tickets,

- protect themselves from obvious rugs.

We’d rather be the launchpad that told you the risks than the one that farmed your FOMO.

How AlphaMind Uses Narratives (Instead of Being Used by Them)

Let’s be brutally honest about something most launchpads won’t say out loud:

In the last cycle, you could slap a hot narrative on a weak project and still raise. That playbook is dying.

Over our first year, we at AlphaMind have:

- run sales in genuinely strong sectors, and

- also experimented with a few “too hot, too early” deals where narrative >> substance.

We’ve seen what happens in both cases – in the order books and in our community chats.

What we learned

- Quantity ≠ quality. Doing more launches just because a narrative is trending almost always backfires for retail.

- Narratives age faster now. By the time CT fully agrees “X is the meta”, most of the upside is already rotated into the next thing.

- Retail is more cynical. A lot of you do read docs, ask about vesting, FDV, treasury, and token utility. That’s a good thing.

Our 2026 operating rules at AlphaMind

Going into 2026, this is how we’re aligning our launchpad strategy with the narrative reality:

- Vertical focus, not vertical worship. Yes, we track RWAs, AI x DePIN, InfoFi, TON/consumer, modular infra, identity, institutional DeFi. But we won’t list a project just because it ticks a vertical box.

- Substance filter first. For each “hot” sector, we ask:

- What is the real‑world or on‑chain value this project is creating?

- Does the token actually capture that value, or is it just a fundraising coupon?

- Are there honest, checkable metrics – users, volume, revenue, AUM?

- Fewer, deeper launches. We’d rather:

- do fewer deals,

- run deeper due diligence,

- involve the community earlier,

- and be transparent when we pass on something even if the narrative is popular.

Because the truth is simple:

Narratives can kick‑start attention, but only fundamentals sustain value.

Our job as a launchpad is to live at that intersection – not on the pure hype side.

What This Means for You as a Retail Investor in 2026

You don’t control narratives. But you do control how you respond to them.

Based on everything we’ve read, scraped, and seen on‑chain, here’s a practical way to use 2026 narratives without becoming exit liquidity:

- Pick 2–3 macro themes you understand. RWAs, AI x DePIN, InfoFi, TON/consumer, infra, identity, institutional DeFi – choose a few, not all.

- Follow primary sources, not only CT. Mix:

- protocol docs and dashboards,

- serious research (Binance Research, Coinbase, BCG, etc.),

- and curated CT voices who data‑check their own takes.

- Separate “narrative timing” from “project quality”. A good project in a cooling narrative can still outperform; a bad project in a “hot” narrative is still a bad project.

- Ask brutal questions about tokens.

- What is this token for?

- Who is buying it in 2-3 years, and why?

- If the token went to zero, would the product still exist?

- Use launchpads as filters, not oracles. Even on a fair launchpad like AlphaMind, your job is to:

- read our DD and MEMOs,

- challenge our assumptions,

- size your allocations to your own risk tolerance.

Not financial advice. Seriously. Do your own research.

How to Stay Ahead of Narratives With AlphaMind

If you want to:

- see early‑stage deals in the sectors we covered above,

- join discussions with other retail investors about what’s real and what’s pure story,

- get our deep‑dive breakdowns on individual projects (tokenomics, risks, unlocks, vesting, FDV vs TGE price, etc.),

…then come hang out with us:

- Website / Launchpad: alphamind.co

- Telegram community: t.me/alphamind_official

- Discord: AlphaMind Discord

We’ll keep sharing our narrative research, internal DD logic, and post‑IDO performance reviews – both the wins and the painful lessons.

Your turn

We wrote this from the perspective of a launchpad that lives between projects, VCs and retail. But we’re still part of the retail side of the table.

So we’d genuinely love to hear from you:

Which narrative do you think will dominate 2026 – and which one is the most overhyped?

Jump into our Telegram or Discord, drop your take, and tag it with #Narratives2026.

We might feature the sharpest comments in a follow‑up piece... and we’ll definitely use them to steer which projects we prioritize for upcoming sales on AlphaMind.

Because if there’s one meta we’re betting on for 2026, it’s this:

Retail getting smarter – and demanding more than just a buzzword on a pitch deck.