AlphaMind ROI Simulator Meets Bondex: A Retail Investor’s Story

When fintech meets narrative, let’s follow Emma, a curious retail investor exploring the world of Web3 tokenomics through Bondex using the AlphaMind ROI Simulator. This case study blends data, tools, and human experience to showcase how everyday users can make informed decisions in crypto.

The Discovery: Why AlphaMind ROI Simulator?

Emma kept hearing about AlphaMind’s ROI Simulator, a free, privacy-first tool designed to deconstruct token unlocks, vesting cliffs, and real investor gains, minus the spreadsheet hassle. She wondered: “Could I model Bondex’s $BDXN tokenomics with it?”

Seeing real-time visualizations, unlock timeline charts, price dynamics, and portfolio ROI, was a pivotal moment. “Smart money simulates,” her friend tweeted with a wink.

You can read more about ROI simulator on the article below. 👇

Introducing Bondex into the Simulator: A Step-by-Step Journey

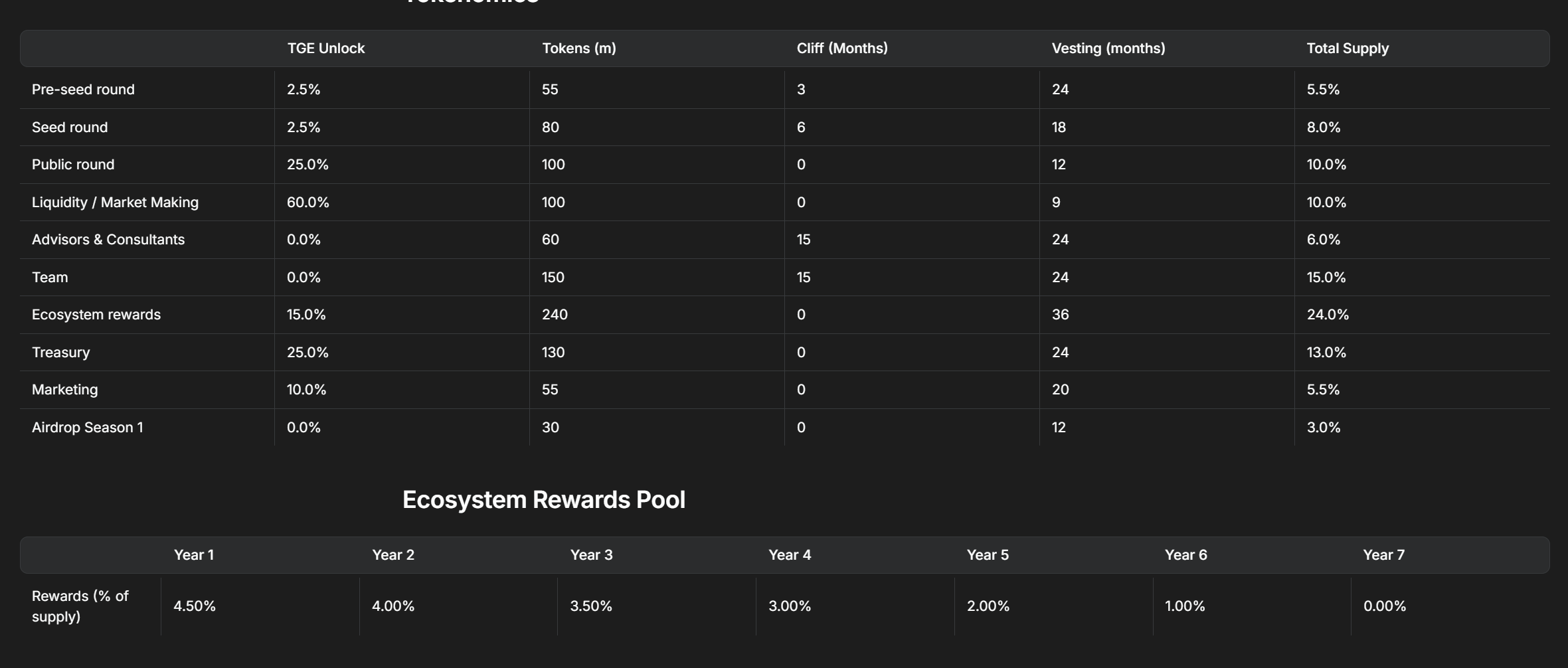

Before Emma could jump into the AlphaMind ROI Simulator, she needed a solid grasp of Bondex’s tokenomics. Understanding how the tokens are distributed, unlocked, and vested over time was critical for building realistic assumptions.

The Bondex ecosystem is powered by BDXN, a utility token with a total supply of 1 billion tokens. These tokens are distributed across multiple categories with varying unlock schedules and vesting cliffs.

Emma’s Step-by-Step Simulation

🖱️ Step 1: Input Token Data

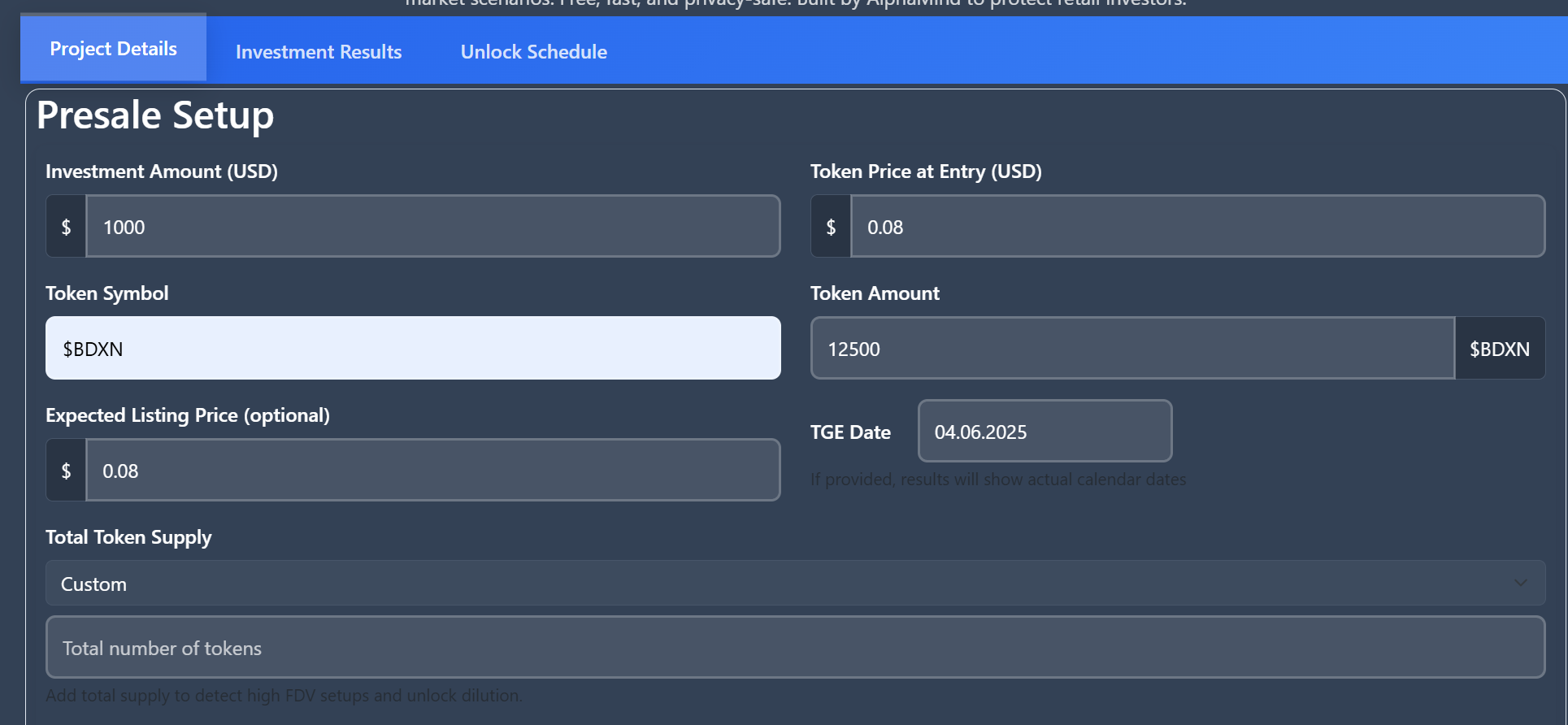

Armed with this tokenomics data, Emma opened roi.alphamind.co and began entering the details:

- Token Name: Bondex (BDXN)

- Entry Price: $0.08 (public sale price)

- Total Investment: $1,000 (equivalent to ~12,500 BDXN at the public sale price)

- Vesting Schedule: Entered all cliff periods and vesting durations from the tokenomics chart above.

📊 Step 2: Apply Market Scenarios

To stress-test her assumptions, Emma configured three market conditions in the simulator:

- 🐻 Bear Case: Price drops 20% post-TGE and remains flat for 12 months.

- 📈 Base Case: Steady growth of +50% in the first year.

- 🚀 Bull Case: Strong demand drives a +100% price increase within nine months.

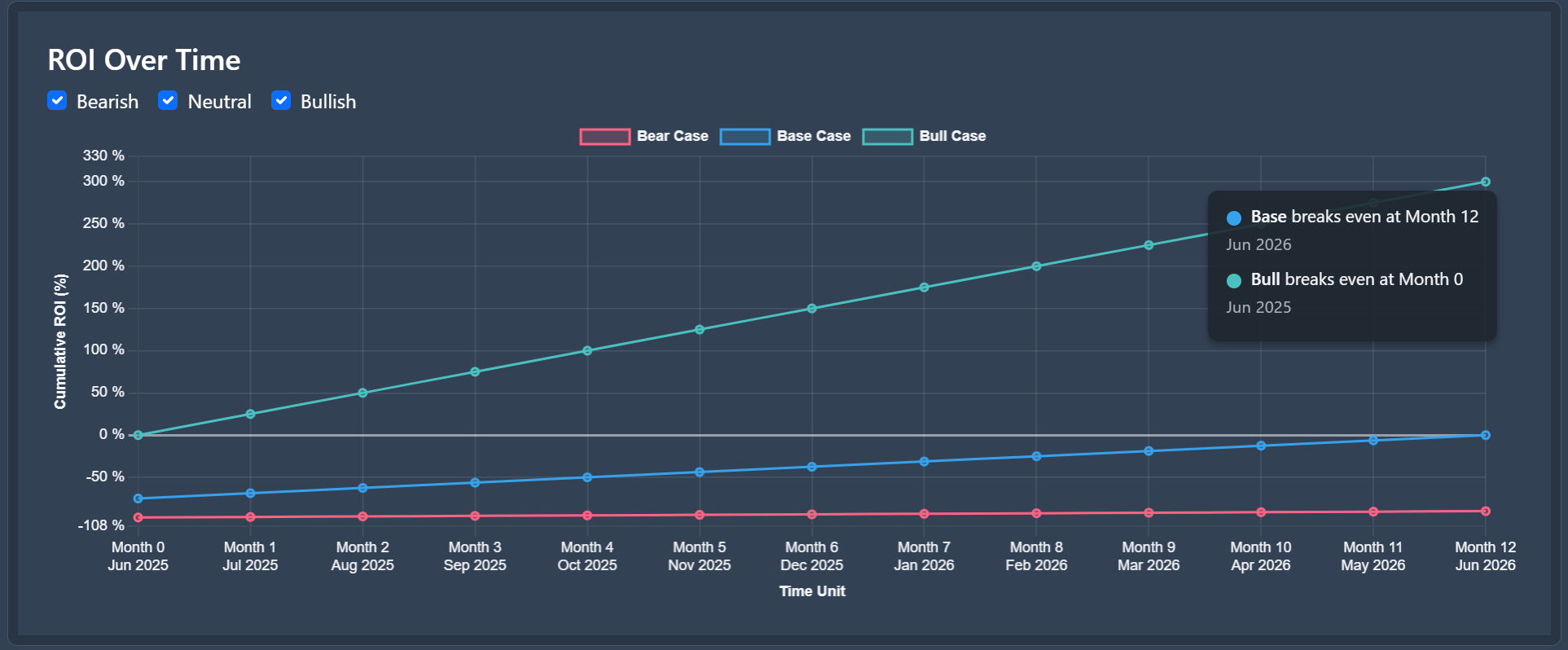

📊 Simulated ROI Analysis

The AlphaMind ROI Simulator projected three possible scenarios for Emma’s $1,000 investment in Bondex:

- 🐻 Bearish Case

- ROI stayed deeply negative throughout the 12-month period, reaching 90% by Month 12.

- Even minimal token unlocks could not offset price declines in a poor market.

- 📈 Base Case

- ROI gradually improved over the year, breaking even at Month 12 (June 2026).

- Conservative growth and careful token release management led to a +300% ROI by the end of the year.

- 🚀 Bullish Case

- Immediate break-even at Month 0 (June 2025) due to strong demand.

- ROI climbed rapidly, reaching +300% in 12 months.

💡 Key Insight: The simulation highlighted how sensitive retail ROI is to unlock schedules and market conditions. The base case assumed a steady adoption curve, while the bull case required sustained demand to absorb token emissions.

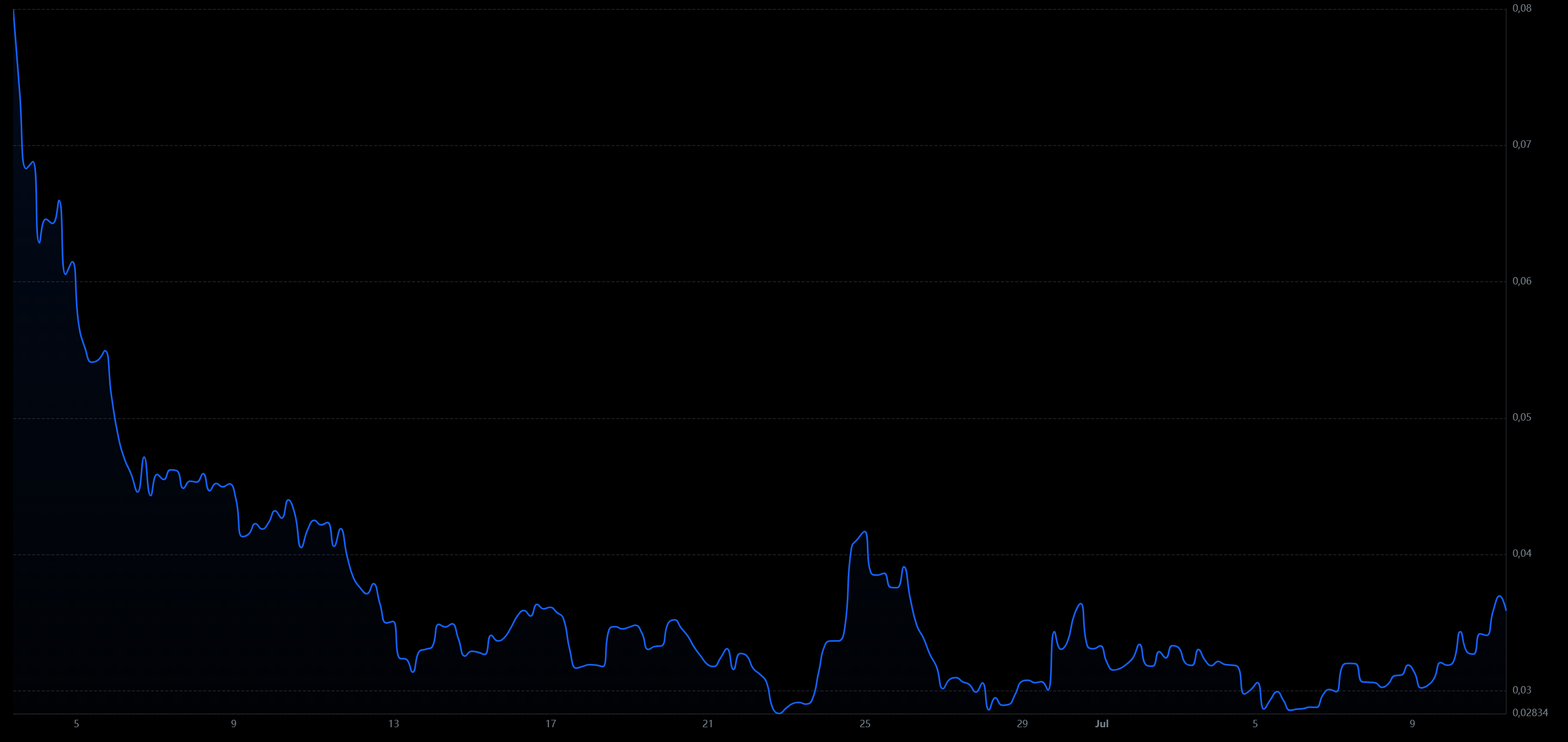

📉 What Happened in Reality?

In the real market, Bondex’s token price initially launched around $0.08 (public sale price) but faced immediate downward pressure. Within days:

- Price dropped sharply below $0.06, signaling early sell-offs by liquid participants.

- Over the next month, it continued declining, bottoming out near $0.028, a 65% drop from the public sale price.

- Small recovery rallies occurred, but the overall trend stayed bearish due to circulating supply increases from token unlocks.

📈 Reality vs Simulation:

- The bearish scenario in the simulator was closest to actual performance in the first months.

- Early unlock events (especially public round and liquidity allocations) likely contributed to downward price momentum.

Conclusion

Emma’s journey with the AlphaMind ROI Simulator taught her one critical lesson: numbers don’t lie, but markets don’t forgive either. While the simulation showed optimistic paths where careful planning could yield up to 300% ROI, reality reminded us that early unlocks and market sentiment can quickly erode value.

For retail investors, tools like the ROI Simulator are invaluable. They don’t guarantee profits but offer a clear lens into tokenomics dynamics—helping you time entries, anticipate cliffs, and manage risk intelligently.

As for Bondex, the project’s fundamentals and community vision remain strong, but patience and strategic thinking will be essential for navigating its token release schedule.

Simulate, don’t speculate. That’s how smart investors stay ahead.

🔗Connect with AlphaMind

We're always here for you: